The state of social media in 2025: Data from Sprout’s latest pulse surveys

Table of Contents

Labubu mania. AI controversy at Cannes. The echoes of infinite “I’m a mommy” clips ricocheting through our brains.

Just over halfway through 2025, we’ve endured enough platform news and unexpected content trends to fill at least three full year calendars. Which is why at Sprout we’re constantly checking in with audiences and social marketers to understand what’s landing in today’s social landscape, what’s falling flat and whether brands really need to concern themselves with the latest form of brain rot.

Our recent Q2 and Q3 2025 Pulse Surveys of over 2,000 social media users across the US, UK and Australia dug into an array of issues—from which emerging platforms are piquing audiences attention (and why) to what people really think it means for brands to be bold on social. Here is what we found.

Throughout this article, * indicates Q2 Pulse Survey data and ^ indicates Q3.

The emerging platforms consumers turn to and why

Between boycotts, bans and new entrants, the last couple years have created unprecedented levels of network fragmentation. More than ever, social teams (and their leaders) are asking questions about which emerging platforms they need to prioritize and how to allocate already limited internal resources.

Sprout’s latest data shows that social users are most eager to increase their time on community-based platforms like Reddit in the near term, more so than nascent spaces like Bluesky or Mastodon. Regardless of platform type, Gen Z and Millennials are most likely to drive adoption. Male users are also more likely than female users to want to test these platforms.

But what’s pushing people into new territory? Across demographics, consumers’ primary motivation for trying new platforms is when they already know people using them—signaling a potential desire to get away from sponsored content and back to the essence of OG, human-to-human social. Gen Z is slightly more likely to be swayed if influencers they like already have a presence on those platforms.

Zooming in on Bluesky

Bluesky remains a one-to-watch, with a user base growing over 370% YoY as of June 2025. Our research reveals more about what’s behind the decentralized network’s appeal.

Current and future users are most compelled by the chance to control what shows up in their feed rather than succumb to another algorithm, and enjoy a space unmarred by ads. Although personal and political views are not a leading motivation for using Bluesky over alternatives, Liberal-identifying consumers (37%) are notably more likely to list this as a factor v. Moderates or Conservatives (21% each).^

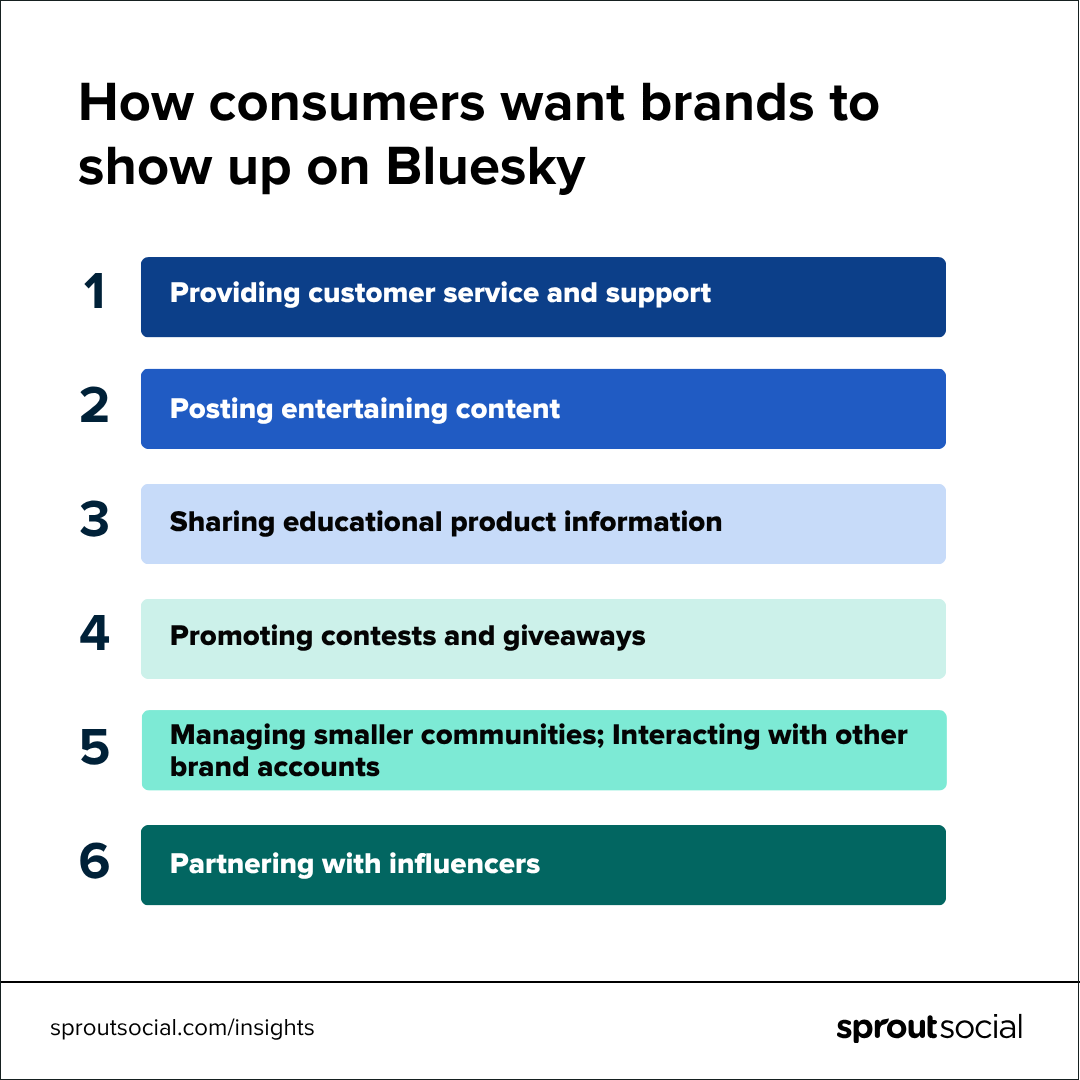

But how do audiences want brands using the platform? Users primarily want brands adopting Bluesky for customer care, along with entertainment and educational content.

And (as with most platforms) audiences want brands to prioritize short-form video under 60 seconds, along with text-based posts and user-generated content.^ For brands whose target audiences are already active on Bluesky, relying on UGC can help you build a presence faster without pressuring teams to create net-new content.

Social media ethics get more nuanced

Social media doesn’t exist in a vacuum—it’s a microcosm of our broader economic, social and technological climate. For brands, this means the “simple” act of posting can be political.

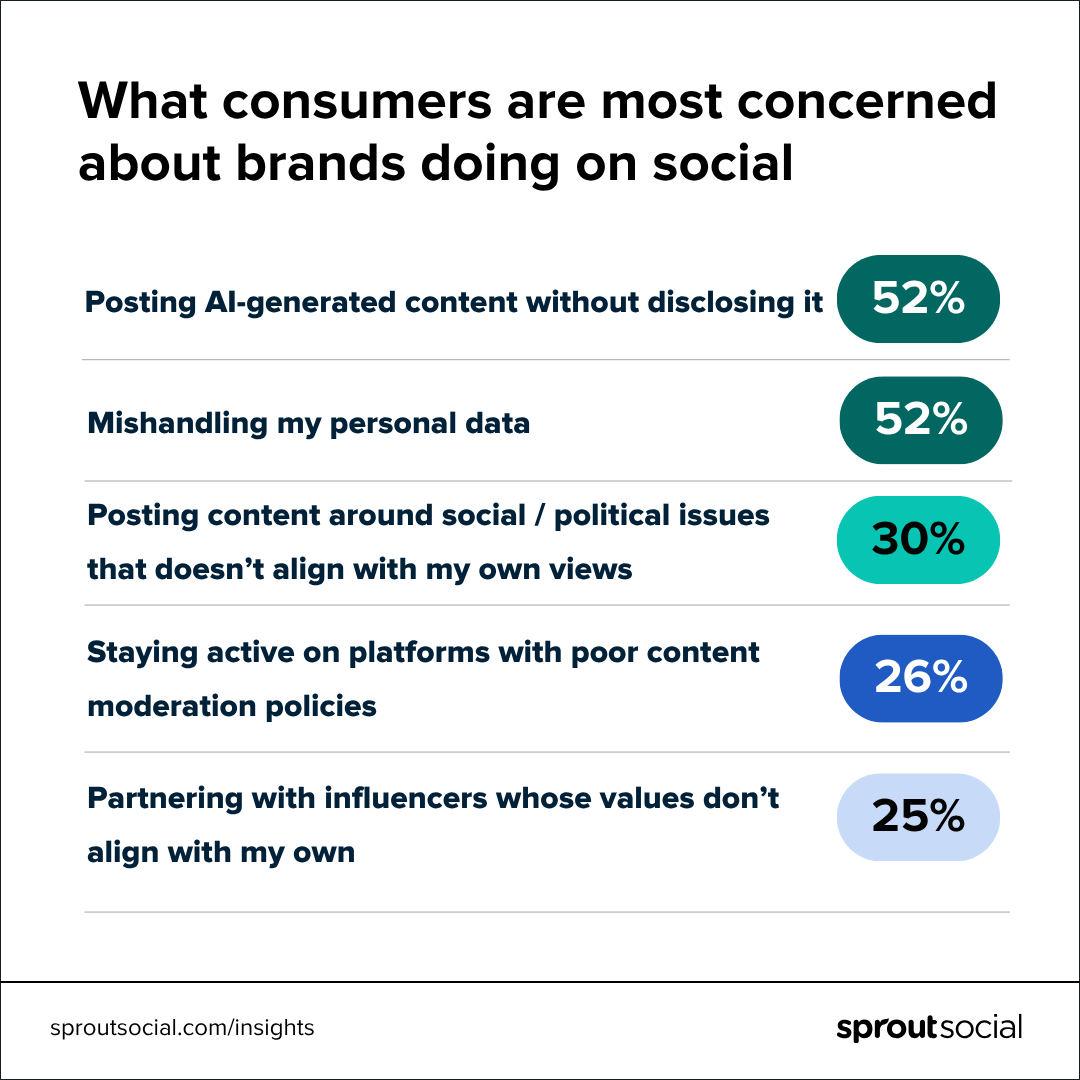

Across all demographics, today’s consumers are most concerned with brands posting (but not disclosing) AI-generated content, and companies mishandling their data. Gen Z and Millennials, however, are more likely to rank AI content disclosure as their top concern, more so than data security.^

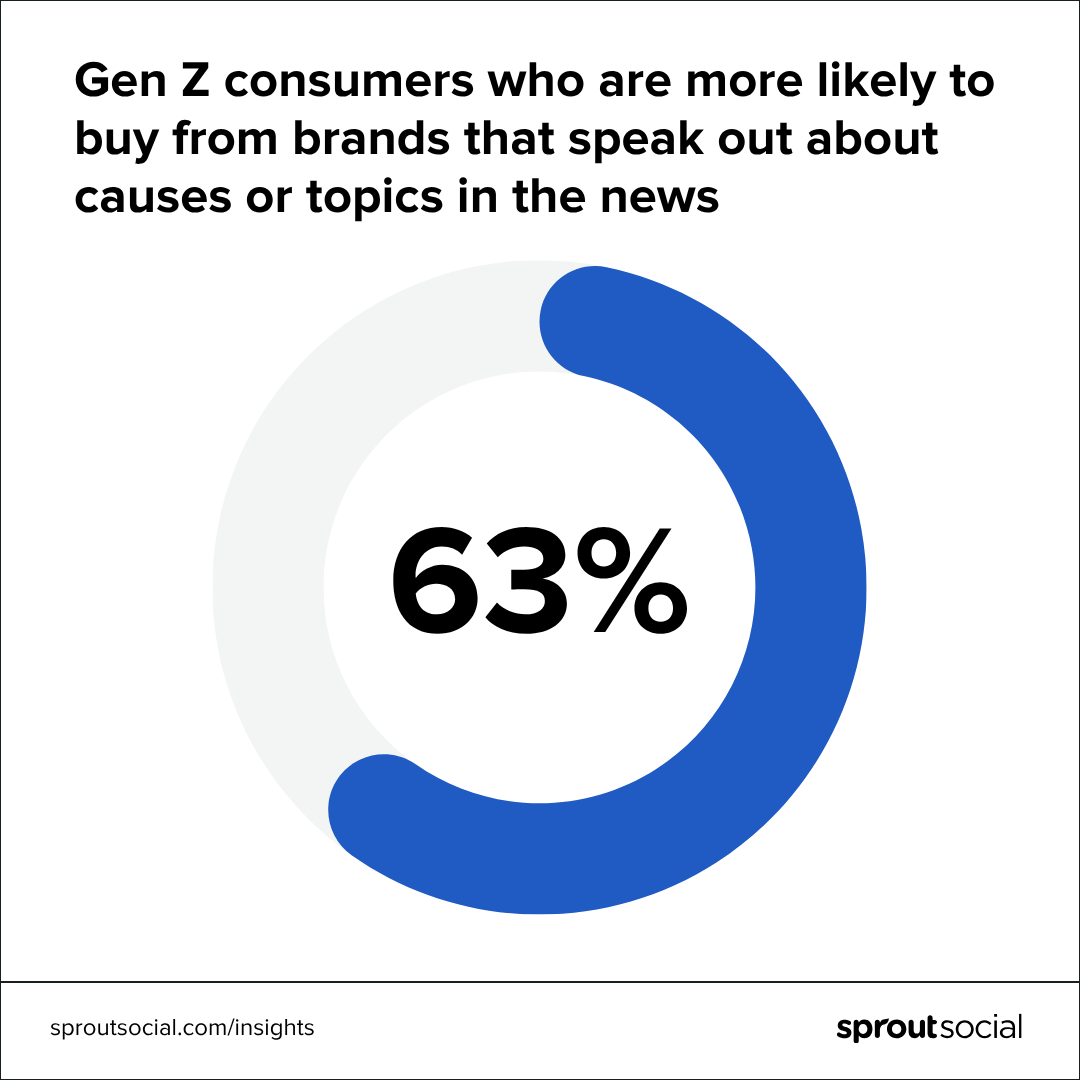

Consumers’ minds are also changing—again—about whether they want brands speaking out about broader social or political issues. As recently as 2023, only a quarter of consumers told us that memorable brands speak out on specific causes. But as of Q3 2025, the pendulum is starting to swing back: 47% say they’re more likely to buy from brands that do this on social. This goes up to 63% for Gen Z and Black consumers, and 61% for Asian consumers.^

There’s no shortage of issues brands could weigh in on. More than ever, marketers need the processes and data to determine which topics they should focus on.

A surprising twist on the personal impacts of social media

Debates about social media’s impact on our wellbeing go back as far as the original networks themselves. More recently, they’ve served as the basis for proposed social media age limits in certain regions. But across the board, our Pulse Survey respondents feel the pros of social far outweigh the cons.

Most consumers (60%) say social has had a positive effect on their mental health over the last six months, compared to only 18% who report a negative effect. More than half (53%) say it’s positively impacted their social lives, and 47% feel it’s improved their financial decisions. There’s a reason “edutainment” continues to top the list of content types audiences seek out on social. People want to learn something new, and they want it delivered in a compelling way.

Across each of these areas, younger generations are the most optimistic. Rather than perceive social as a time suck, a magnet for impulse purchases or a solo activity, Gen Z and Millennials are curating their feeds to become a welcome reprieve from troubling current events and mining platforms for much needed financial education (e.g., FinTok) and community bonding that is additive to their in-person social circles.

How consumers want brands to show up right now

No day passes in the world of social without a new example of brands striving to be unhinged, or a marketer waxing poetic about the importance of authenticity. But how does this line up with audience expectations?

Our research shows that consumers perceive “bold” brands to be honest and inspirational—more so than trendy, funny or unfiltered.

Reinforcing our findings from The 2025 Sprout Social Index™, the companies that stand out on social are those that are upfront about their products, services and what they stand for. So it’s unsurprising that the #1 thing audiences would call out brands for is being unethical—more so than their pricing, or the stances they take on public issues.

Growing demand for serialized content

In this context, it’s clear people aren’t opening up their social apps just to see a stream of brands jumping on the latest AI-generated content trend. When asked what brands should prioritize most on social right now, consumers put equal weight on audience interactions and publishing original, recurring content series.

Like The 2025 Content Benchmarks Report highlights, making an impact on social isn’t necessarily about posting more—it’s about creating valuable content and connections. Serialized content gives brands the room to tell richer stories and make their customers feel seen.

Respondents told us that they’re most compelled to engage with brand series when they tell complete stories within each post or episode, and when they feature a cast of characters they get to know over time. The best part? These constraints are network and format agnostic.

eBay Motors’ recently went all-in on an Instagram series where they sent two auto influencers to the 2025 Miami Grand Prix (the first two episodes alone earned nearly 5 million views). Taking video completely out of the equation, dating app Hinge announced the second “season” of its No Ordinary Love Substack series, where writers tell the real love stories of couples who met through the platform.

Craving content with the human touch

Throughout 2025, we’ve seen brands start to embrace AI-generated content trends, from action figures to Studio Ghibli-inspired illustrations—to mixed audience reactions.

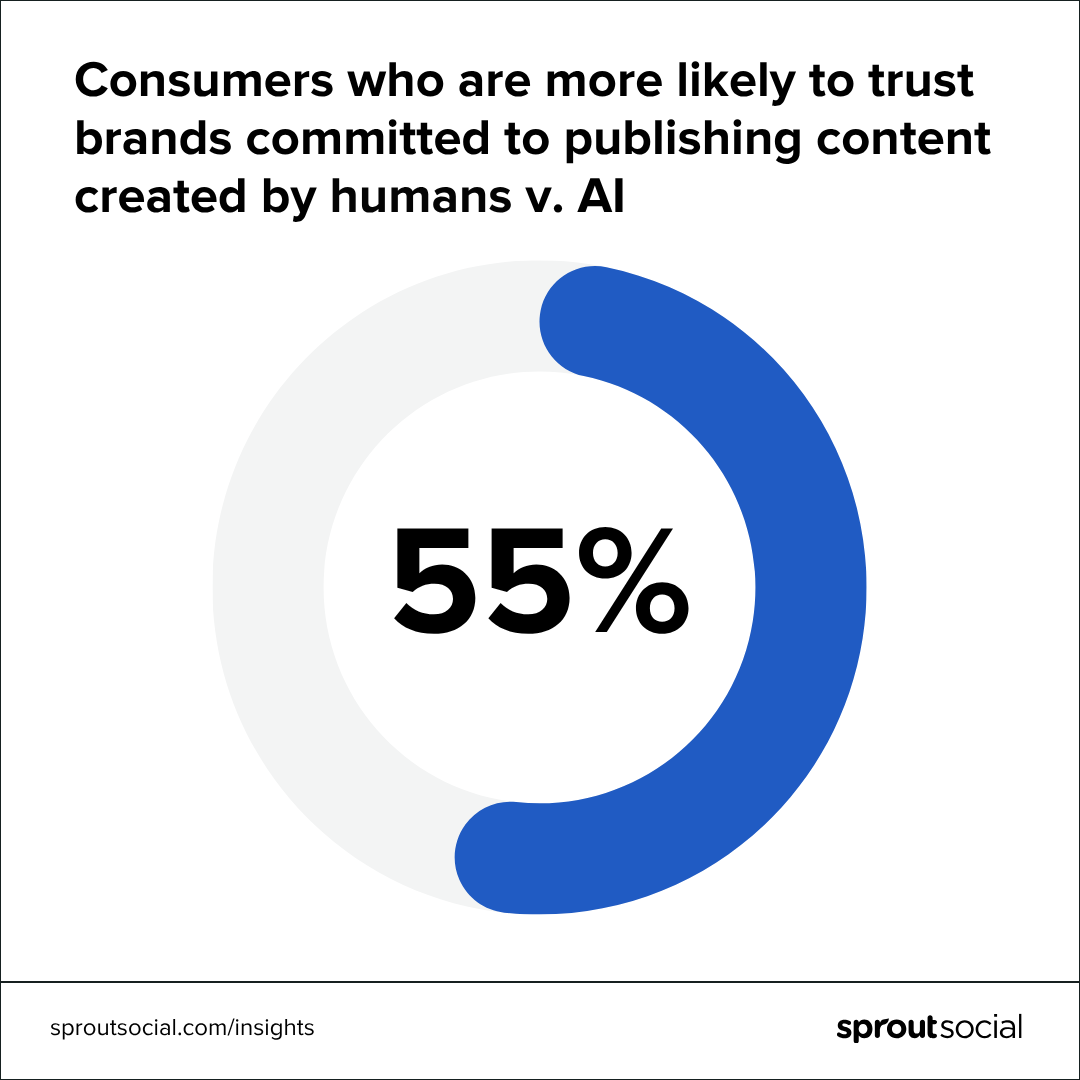

Today, 55% of consumers say they’re more likely to trust brands that are committed to publishing content created by humans v. AI. This rises to 62% for Millennials, and 61% who identify as Liberals.^ There is still debate around who is responsible for disclosing when social content is AI-generated, but for most audiences, crediting the people behind the posts is the true mark of distinction. Brands like Fishwife, for instance, have made it a point to highlight the craftspeople behind content like this mussel shell fashion collection inspired by their recent product launch. They also consistently credit the photographers and stylists who bring their posts to life.

This sentiment holds when it comes to influencers too. Almost half (46%) of consumers are not comfortable with brands using AI influencers and 31% say it depends on the campaign.^ Digging into demographics, male consumers are slightly more comfortable with these virtual collaborations (28% v. 19% of female consumers), as are younger generations (32% of Gen Z and 33% of Millennials, compared to 23% of Gen X).

Social media and the customer journey

We’ve said it before but it bears repeating: All business is social. Our latest data confirms that brands need to be investing in social as a full-funnel channel (not just a peripheral tactic)—or risk losing market share to competitors that do.

Exhibit A: the rise of social search. While most people’s primary instinct when looking for information is still to turn to traditional search engines—Gen Z ranks social as the #1 place they turn to. Whether they’re looking for product reviews, restaurant recommendations or how-to tutorials, audiences increasingly want answers from real people (and often, in video form). Social networks deliver on both.

As consumers devote more attention to their feeds, the potential for social to drive real-world financial implications grows. No matter how you look at it, the actions brands take—or fail to—on social impact audiences’ decision to buy or defect.

More than three-quarters (76%) of Pulse Survey respondents say social (be it ads, influencer or brand content) has impacted their purchases over the last six months. And almost as many (64%) say when a brand partners with one of their favorite influencers, they’re more willing to buy.

Even in a difficult economic climate, younger generations are more likely to buy things they discover on social. Between the downstream impacts of tariffs and continued corporate layoffs, only 28% of all consumers say they’re more likely to buy something they found through social in the coming months. This rises to 43% for Gen Z and 36% for Millennials—proving that audiences are still willing to pay for the right product or service. This trend is particularly noticeable on platforms popular with younger demographics; for example, recent Snapchat statistics show significant engagement and purchasing power among its user base.

A new source of truth for financial education

Knowing how many users feel social has positively impacted their financial decisions, it makes sense that 61% plan to use social to research financial guidance in the near future. More than 80% of Black, Asian and Gen Z consumers plan to use social to find financial information, along with 77% of Millennials.^

Consumers are most likely to search for topics related to building a long-term financial cushion, including investments and savings accounts. This presents a massive opportunity for financial services brands. A captive audience is actively seeking educational information about financial wellness, trying to understand their options. Brands that heed this call will be top of mind when consumers decide to open an account or hire a new adviser.

The go-to destination for travel planning

Raise your hand if you also lost hours searching TikTok for itinerary inspiration ahead of your last trip.

You’re not alone: Leisure travel is expected to become a $15 trillion industry, and 69% of consumers will likely use social to plan an upcoming getaway. This rises to 81% for Millennials and 87% for Gen Z.^

Customer feedback on review platforms is the #1 factor impacting consumers’ decision to book with a travel or hospitality company, followed by the quality of their social customer care. As our 2025 Content Benchmarks research shows, inbound engagements are up to 127 per day for travel and hospitality brands (well above the cross-industry standard). Audiences aren’t looking for these businesses to post more, but to engage more and respond faster.

Center your strategy around the (current) state of social media

The smartest changes to any social strategy are driven by real audience insights, not random stakeholder requests. Whether you’re debating a shift to a new platform or building out your content plans for the months ahead, let these Pulse Survey findings serve as a valuable gut check.

In some ways, the state of social media right now is more complicated than ever. But our data hints at a few ways brands can start to simplify: Find opportunities to restore the 1:1 nature that so many users miss about the early days of social. Free your team from chasing questionable trends and instead focus on original content series only your brand can own. Most importantly, don’t underestimate the business results social can drive—when you invest wisely.

For more insights around how marketers can adapt to the current state of social media, download The 2025 Sprout Social Index™.

Share