For financial services brands, social media is a risk mitigation friend—not foe

It was a scene out of futuristic fiction—a decades-old bank collapsing mere hours after a social media post went viral. In what was supposed to be a non-event, Silicon Valley Bank (SVB) announced they were selling securities to raise capital. Soon, subsequent Tweets questioning the health of SVB went viral. The posts prompted depositors to withdraw $42 billion within 10 hours, a devastating blow that led state regulators to close the bank. SVB wasn’t the only bank to experience a social media-induced run this year, with First Republic Bank following suit and collapsing two months later.

Coupled with the unpredictable nature of social media and the looming economic downturn, many weary financial services executives see social media as a threat. Add viral “meme stocks”—stocks that can become overvalued due to positive online sentiment—to the mix, and it became clear social media has real world implications and the potential to derail financial companies.

But refraining from social media altogether only creates more room for crises to snowball and brand health to plummet. More than ever, financial services brands must take steps to use social media as an essential part of their risk mitigation and brand safety strategy, instead of downplaying its impact or fearing it.

Stop a crisis in its tracks with social listening

Customer sentiment can change overnight. By employing brand safety tools like social listening, teams can jump into action at the first sign of trouble. Listening enables financial institutions to perform swift situation analysis and crisis management, which are crucial for successful crisis responses.

In a recent webinar, Sprout Social CFO Joe Del Preto explains how listening can help brands facing a crisis: “Identify the crisis before you have a bigger problem on you hands, and respond appropriately, ensuring your team is empowered with the correct information. It comes down to proactively managing reputational risks with consumers, employees and the market on social.”

Ryan Phillips, a Sprout Solutions Engineer with experience managing social in the finance industry, echoes the benefits of listening. “Risk mitigation goes beyond monitoring comments and engagements on the corporate page. It should encompass conversations across the internet. That’s why social listening is the most valuable way to mitigate risk. It stops ripples about your brand online from becoming a tidal wave.”

To see social listening at work, read Sprout Social’s analysis of GameStop, the meme stock at the center of an internet-prompted short squeeze. Our data illustrated how mentions of GameStop (GME) increased 2,805% in one week in early 2021, and perfectly correlated with the price fluctuations of the brand’s stock. Had hedge funds caught onto the buzz surrounding GME stock sooner, their financial consequences might not have been so severe.

Using a listening solution like Sprout Social enables you to automatically sift through billions of data points in seconds, detecting market trends before they go viral (or have material implications). These AI-powered tools capture pivotal data like the sentiment, volume, unique authors and growth over time of topics related to your brand.

Use social to uncover real-time voice of customer data

The benefits of social go far beyond monitoring volume and stopping an existing crisis from growing. Social listening offers valuable voice of customer (VoC) data that keeps you up to speed on the health of your business, the industry overall and fluctuations in consumer preferences.

Take Del Preto’s social listening ritual. “My head of investor relations has social listening queries running at all times that are tracking what our competitors are doing. Did they launch a new product? How does our sentiment compare to theirs? We make sure we stay ahead of anything that could bubble up to cause major problems, or present new opportunities,” he says.

For financial service brands, social listening queries can surface everything from stock market trends to negative discourse surrounding their company or products. Del Preto explains, “I know dozens of financial services firms using listening…They use it for risk mitigation, competitive analysis, trend spotting and staying up to date on industry news.”

Phillips explains why all of this data exists on social: “When someone is looking for a [financial solution], they go on social media and see what their friends recommend. Then, they look up your profile to get a first impression of your brand…Social is where your community is talking about solutions to their financial problems.”

This is especially true for Gen Z consumers. According to Accenture, 82% of consumers aged 18-24 acquired a financial services product from a new provider in the past 12 months, proving that younger demographics are a growing market whose loyalty is up for grabs. Social is critical for reaching this audience and discovering more about their needs, especially for traditional and legacy brands fighting for market share against digital-only challenger banks.

Listening enables you to tap into consumer conversations, and deliver insights and key learnings you need to guide your organization-wide strategy. The tools reveal how consumers feel about your competitors, and help you identify industry gaps to find new opportunities to differentiate your business.

Provide a best-in-class customer experience—on social and beyond

Social is a prime place to boost your discoverability, drive brand awareness and loyalty, and help your company deliver business development results—while ensuring higher customer satisfaction. Brands achieve this by creating meaningful connections with customers and advocates, and providing real-time customer care. But Phillips warns this can create reputation risks if you don’t have a strong customer care strategy in place, or if you have an inconsistent posting cadence.

Data supports his claim. According to The 2022 Sprout Social Index™, when consumers wait too long for a brand to respond on social, 36% say they will share that negative experience with friends and family. A comparable 31% won’t complete their purchase, while 30% will buy from a competitor instead.

Your audience wants to see that you care about helping your customers, and have a POV on the pain points, topics and trends that matter most to them. For example, see how expense management solution company Brex creates content that speaks to the needs of their target audience.

And attentively responds to incoming customer queries on social.

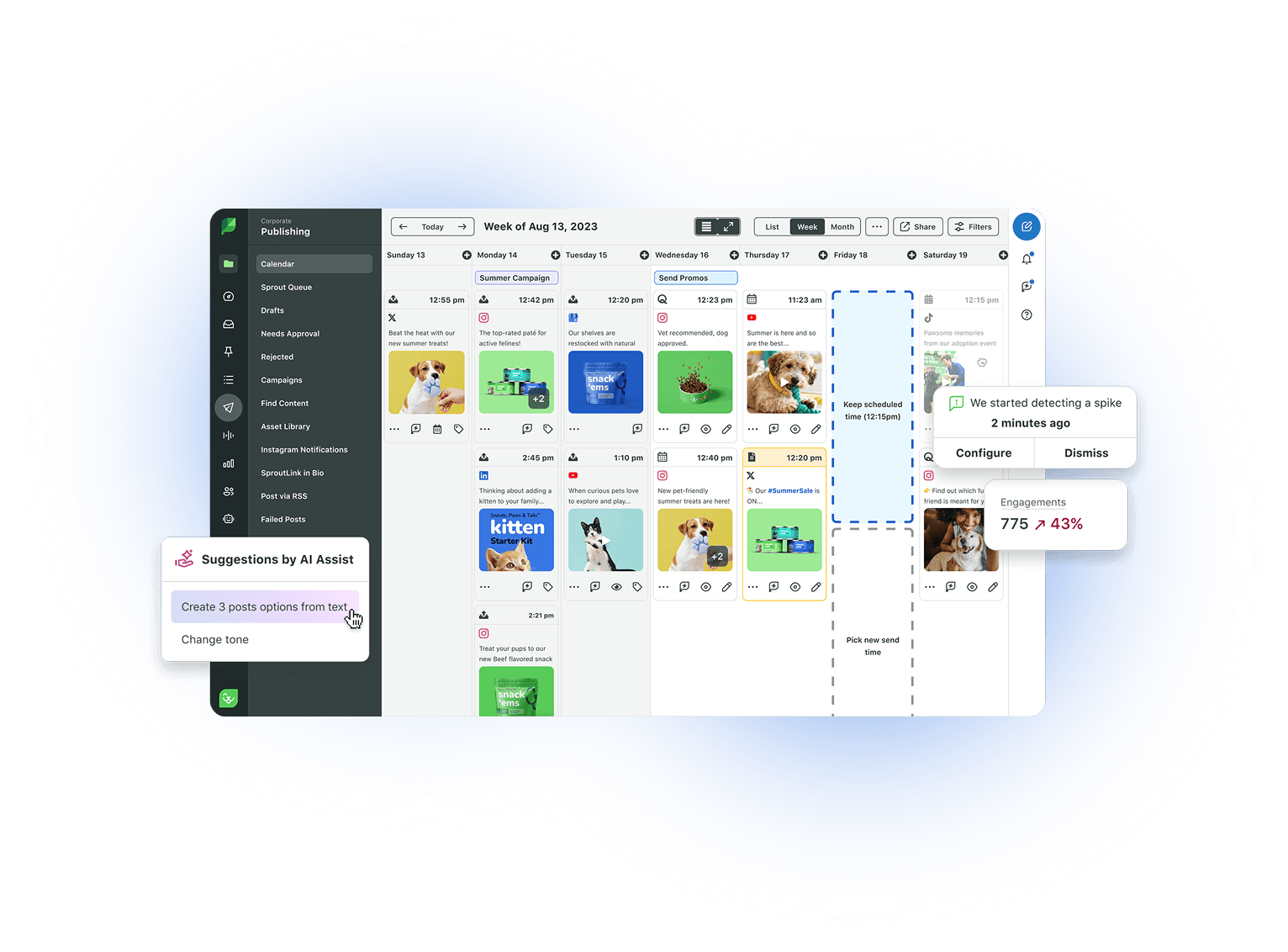

With a social media management tool, you can empower your team to create consistent and compliant brand experiences that level-up to your organization’s goals. A tool like Sprout enables you to elevate customer care experiences, find authentic ways to engage your audience, streamline your posting strategy and make more strategic decisions with analytics solutions.

As part of a proactive approach to brand safety, use our social media compliance checklist for financial institutions as a step-by-step guide to reducing risk online.

Keep your friends close and social insights closer

Especially in highly regulated industries, it’s easy to see social as a threat rather than an opportunity. But the right social media management partners can help your company see around the corner of a crisis and future-proof your strategy long-term. Rather than get caught up in a downward spiral, build consumer confidence and boost brand awareness on social.

Looking for more insight into how you can build a compelling social presence? Checkout these social media tips for banks and financial institutions to help you maximize performance and minimize risk.

Share