Australian social media demographics to inform your strategy

Table of Contents

With 20.8 million social media users, it’s estimated around 76% of Australians are actively engaged on social networks.

But how can brands effectively reach these users? The first step is to take a closer look at the social media demographics in Australia. From generational trends to platform preferences, we cover the must-know details about Aussie social users and their online behaviours.

Social media usage demographics in Australia

As social media continues to evolve, Australians aren’t just using it to chat with friends and family—they’re using it to stay connected to the world around them. From sporting events to social causes, economics to entertainment, social media is offering a window into the global trends and events Aussies care about.

- Per a 2024 Deloitte report, Australians predominantly use social media to browse feeds, watch videos and message with friends.

- The report also found that approximately one in five Australians creates social media content to generate income. Gen Z most actively earns money from social media, with 40% of users in this demographic using it as an income source.

- According to The 2025 Sprout Social Index™, 91% of Australian social media users use it to keep up with trends and cultural moments.

- The Index also reports that 93% of users say it’s important for brands to keep up with online culture via their social media accounts.

Social media networks by age group in Australia

Australians are spending their time across a range of social media networks, including legacy sites and emerging platforms. These are the platforms Australians are using the most:

- According to the Deloitte report, nearly all generations—Millennials, Gen X, Baby Boomers and Matures—use Facebook, YouTube and Instagram the most.

- However, the data reveals that Gen Z uses Instagram, YouTube and TikTok the most.

- Facebook’s popularity seems to be declining with younger generations—and this trend is expected to continue. The number of Australian Facebook users is projected to decrease by 47 million users from 2024–2028.

- Australians are becoming increasingly open to decentralised social media networks, such as Bluesky. In November 2024, Bluesky was listed as Australia’s top-ranked social media app in both Google and Apple’s app stores.

The most active generation on social media in Australia

To understand social media demographics in Australia, you need to examine each generation’s engagement. While Australians of all ages use social media, younger users are more active than their elders. According to Deloitte, here’s a snapshot of how much time each generation spends on social media per week:

- Gen Z: 10 hours and five minutes

- Millennials: seven hours and 45 minutes

- Gen X: six hours and five minutes

- Baby Boomers: four hours and 30 minutes

- Matures: two hours and 40 minutes

In terms of daily use, 56% of respondents said they spend anywhere from 1–5 hours on social media each day. For many, once they start scrolling, it’s hard to stop: 46% said they regularly spend more time on socials than initially planned.

The report also highlighted that Australians have mixed feelings about their time spent on social media. While 33% feel concerned, 33% aren’t concerned and 33% feel neutral or declined to share their sentiments.

How government policies may change social media demographics

Social media demographics in Australia are expected to change in 2026 and beyond. In November 2024, the Australian Government announced that it would be setting a minimum age of 16 for social media.

Set to take effect in December 2025, the bill will cover networks like Facebook, Instagram, Snapchat, TikTok and X. However, YouTube will be exempt, with the government citing its primary purposes as “education and health support.”

With this in mind, networks subject to the law can expect to see their under-16 user base fall dramatically. In contrast, YouTube may see a significant uptick in under-16 users as it will be one of the few social media sites they’re allowed to access.

The ban could also shape young people’s content preferences on social media for years to come. While short-form content is currently king, especially on networks like TikTok and Instagram, under-16s will no longer have the same level of access to it. Instead, they’ll have primarily long-form video content available on YouTube, which could skew their preferences accordingly.

Australian brands looking to connect with under-16s must take the bill and its potential outcomes into consideration. To reach this audience beyond 2025, they’ll need to explore alternate platforms and monitor changing preferences and behaviours.

How do social media behaviours differ by age group in Australia?

Every generation uses social media differently. Regardless of who you’re hoping to market to, it’s crucial to understand these distinctions. Below, we break down the ins and outs of each age group so you can master generational marketing.

Gen Z: Spontaneous shopping and social activism

Nicknamed digital natives, Zoomers were born into the era of the internet. That’s why it’s no surprise they’re some of the most active social media users in the world. Below is a snapshot of how Gen Z is using social media in Australia:

- Per Deloitte, Australian Zoomers spent most of their social media time on Instagram, YouTube and TikTok in 2024.

- According to the Q1 2024 Sprout Pulse Survey, Gen Z is most likely to use social to discover new products, keep up with the news and seek customer care from brands.

- According to The 2023 Sprout Social Index™, Gen Z are impulsive social shoppers. Over 50% of Gen Z consumers make monthly or weekly spontaneous purchases due to something they saw on social.

- While Gen Z are discouraged by brand-led activism, they’re passionate about influencer activism. Nearly all Zoomers agree that influencers should take public stances on social issues.

Millennials: Multitaskers who crave originality

Millennials’ social media behaviours are layered and nuanced. For most Millennials, social media isn’t just part of their daily routine—it’s how they start their day. However, while they’re digitally invested, they’re also easily distracted; many split their attention across multiple tasks and platforms. Additionally, although they’re receptive to social media advertising, it needs to be authentic and unique to resonate.

- The 2024 Deloitte report showed that Australian Millennials spent most of their social media time on Facebook, YouTube and Instagram in 2024.

- Another 63% of Millennials, according to the report, are more influenced by social media advertising than other forms of advertising.

- Over three-quarters (78%) of Millennials engage with media to start their day, most commonly by browsing social media (28%), the report showed.

- The report also revealed that 68% of Millennials frequently multitask while using social media, so brands must prioritise content that’s instantly compelling and easy to consume.

- Millennials value originality on social media, so companies should focus on developing unique content rather than jumping on trends.

Generation X: Responsiveness and risk appreciation

While Gen X users are most active on established social media platforms, their expectations are anything but traditional. Users in this demographic are most drawn to brands that are responsive and creatively daring.

- Per Deloitte’s 2024 report, Australian Gen X spent most of their social media time on Facebook, YouTube and Instagram in 2024.

- Like Millennials, Gen X value originality in branded social media content. However, responsiveness to customers is what helps them remember a brand the most.

- Gen X respect brands that take content risks, appreciating innovation and creativity. Businesses that defy expectations in their marketing campaigns are likelier to capture the attention of this demographic.

Baby Boomers: Staying loyal to legacy platforms

Instead of experimenting with new networks, Baby Boomers are sticking with familiar social sites that help them stay connected.

- Per Deloitte’s 2024 report, Australian Baby Boomers spent most of their social media time on Facebook, YouTube and Instagram in 2024.

- Compared to younger generations, Baby Boomers are far less likely to embrace new social media networks. According to a Q4 Sprout Social Pulse Survey, only 14% of Baby Boomers were on Threads—a below-average adoption rate.

- Baby Boomers place significant trust in influencers. The Pulse survey found that 47% of respondents used influencer recommendations as their main source of holiday gift inspiration. Of all generations, Baby Boomers were the likeliest to say influencers inspire their gift ideas.

Facebook: Australia’s demographics and usage

- Number of users: 21 million

- Largest age group: 25–34 (25.6%)

- Gender distribution: 52% female; 48% male

- Time spent per month: 20 hours and 15 minutes

Takeaways

- Although Facebook’s largest user base is aged 25–34, it’s still widely used among older demographics. Brands looking to market to Gen X and Boomers can (and should) still focus their efforts on Facebook.

- Because Facebook has a near-even gender split, gender-neutral campaigns have the power to perform well. Marketers can also conduct A/B testing to compare the performance of male and female-centric campaigns.

YouTube: Australia’s demographics and usage

- Number of users: 20.80 million

- Largest age group: 18–34 (over 50%)

- Gender distribution: 51% female; 49% male

- Time spent per month: 21 hours and 36 minutes

Takeaways

- The bulk of Australian YouTube users are Millennials and Gen Z. To effectively market to them, brands must consider the content these generations enjoy and integrate these into their strategy.

- For example, per Sprout’s 2026 Social Media Content Strategy Report, Gen Z is the most likely to say brands should interact in smaller, community-driven spaces.

- The average Australian spends over 21 hours on YouTube, signalling habitual use and high engagement. Marketers can capitalise on this by developing episodic series or binge-worthy content that encourages users to keep coming back.

Instagram: Australia’s demographics and usage

- Number of users: 13.95 million

- Largest age group: 25–34 (45%)

- Gender distribution: 56% female; 44% male

- Time spent per month: 11 hours and 46 minutes

Takeaways

- Because Instagram commands a large portion of Australia’s online user base, businesses can use it to increase brand awareness and reach new audiences.

- With mostly female users, Instagram is particularly well-suited to companies in industries like beauty, fashion, wellness, lifestyle and parenting.

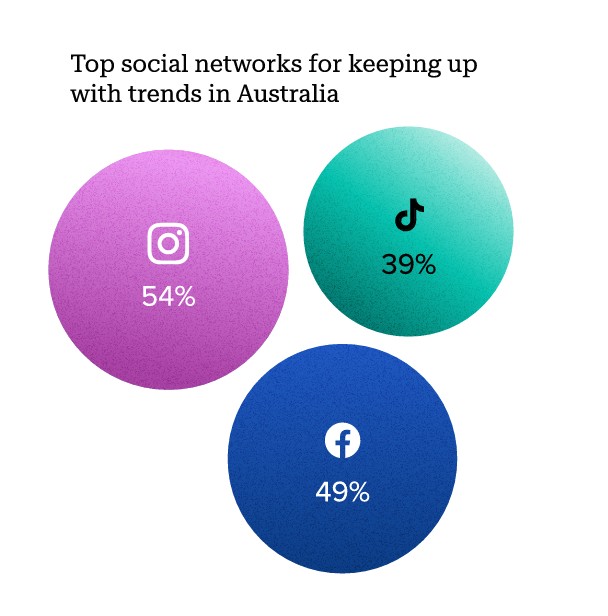

- Per Sprout’s 2025 Social Index™, 54% of Aussie Instagrammers use the site to keep up with trends. Marketers need to monitor these trends to develop a nuanced understanding of online culture and create content accordingly.

LinkedIn: Australia’s demographics and usage

- Number of users: 15 million

- Largest age group: 25–34 (global)

- Gender distribution: 46% female; 54% male

- Time spent per month: 1 hour and 6 minutes

Takeaways

- Monthly time spent on LinkedIn is low, signalling highly intentional usage. Whether it’s to send connection requests, explore job postings or reply to DMs, it’s safe to assume that LinkedIn users have a clear purpose when opening the app.

- As such, brands need to prioritise captivating copy and high-quality visuals to quickly capture users’ attention.

- According to Sprout’s 2024 Content Strategy Report, users expect brands to share educational product information, manage smaller communities and offer customer support on LinkedIn.

Case study: Learn how pay.com.au mastered the art of educational storytelling on LinkedIn to build trust and cut through the noise in the Australian fintech space.

TikTok: Australia’s demographics and usage

- Number of users: 5 million

- Largest age group: Under 24 (over 50%)

- Gender distribution: 51% female; 49% male

- Time spent per month: 42 hours and 13 minutes

Takeaways

- TikTok boasts the highest engagement time of any social media site in Australia, making it a prime platform for brands looking to inspire, educate or entertain via short-form video content.

- TikTok’s largest user base is Gen Z. Per Sprout’s 2024 Social Media Content Strategy Report, 77% say TikTok is their favourite network for discovering new products. To align with this preference, businesses should prioritise content like product launches, unboxings and tutorials.

- The report also found that 62% of Zoomers use TikTok to seek customer care. Brands must ensure they’re properly positioned to provide this support (e.g. promptly replying to DMs and addressing concerns in the comments).

Snapchat: Australia’s demographics and usage

- Number of users: 8 million

- Largest age group: Over 25 (45%)

- Gender distribution: 49% female; 50% male (global)

- Time spent per month: 17 hours and 2 minutes

Takeaways

- While the app has long been associated with teens, Snapchat data shows that nearly half of its user base is over 25—a sign that users stay on the app long term. This presents an opportunity for brands to evolve their content as their audiences age and experiment with more nuanced messaging.

- The same data reveals that Australian Snapchatters open the app an average of 40 times per day to exchange messages, share updates and watch highlights of their favourite shows. Marketers can capitalise on these frequent visits by promoting bite-sized content in the Discover feed.

- According to Snapchat, 60% of Aussie users interact with Augmented Reality (AR) Lenses daily. This gives businesses a unique opportunity to blend entertainment with promotion through filters like virtual try-ons.

Pinterest: Australia’s demographics and usage

- Number of users: 1 million

- Largest age group: 14–24 (reaches 41% of this demographic)

- Gender distribution: 66% female; 34% male (global)

- Time spent per month: 1 hour and 46 minutes

Takeaways

- Pinterest isn’t where Australians go to mindlessly scroll—it’s where they go to actively plan purchases. Users who save something on Pinterest are 7x likelier to eventually buy it.

- Gen Z is Pinterest’s fastest-growing user base. Per Pinterest, they save almost 2.5x more Pins and make 66% more boards than other generations.

- To show up in Pinners’ high-intent searches, brands must choose striking visuals (both images and videos) and inject relevant keywords into their titles and descriptions.

- Pinterest’s predominantly female user base is shaping predicted trends, such as “Goddess Complex” and “Sea Witchery” makeup looks.

X (formerly Twitter): Australia’s demographics and usage

- Number of users: 4.03 million (projected figure for 2025)

- Largest age group: 25–34 (global)

- Gender distribution: 32.5% female; 67.5% male

- Time spent per month: 2 hours and 31 minutes

Takeaways

- Because its user base mostly consists of men, X is an ideal outlet for brands in traditionally male-dominated sectors, such as sports, tech, gaming and finance.

- X has a unique ability to facilitate real-time conversations and updates, which is a major drawcard for its Aussie users. Marketers can capitalise on this by sharing commentary, thought-provoking questions or culturally relevant content.

Social media for news consumption by age group in Australia

Australians, particularly those in younger demographics, are increasingly using social media as a news source.

- According to a 2024 report, 70% of Australians aged 18–24 use social media to access news; 46% named social media as their main news source.

- The report also revealed that 64% of Australians aged 25–34 access news via social media; 38% listed social media as their main news source.

- In contrast, according to the report, only 22% of Australians aged over 75 use social media as a news source.

With more Aussies seeking out their news on social media, concern over misinformation has increased. Per the University of Canberra, 75% of Australians are worried about distinguishing fact from fiction on social networks—an 11% increase since 2022.

Social commerce by age group in Australia

In addition to acting as a source of news and entertainment, Australian consumers are using social networks to browse, discuss and purchase products and services.

- Approximately 57% of Australians have engaged in social shopping activities.

- Statista data shows that Millennials had the highest social shopping engagement in 2022, followed closely by Gen Z.

- Facebook was the preferred social commerce platform among Millennials, whilst Instagram and TikTok were more popular with Zoomers, Statista data showed.

- In 2025, Millennials are expected to account for roughly one-third of social media shopping worldwide. Zoomers will likely be a close second, accounting for 29%.

- Per a 2023 survey, 58% of respondents shopped on Facebook, making it Australia’s most popular social commerce site. YouTube took second place, with 44% of participants having bought something on the platform.

- In 2023, 40% of Aussie social shoppers in Australia used Instagram to make purchases.

Using social media demographics in Australia to strategise smarter

By reviewing social media demographics in Australia, you’ll have a better understanding of your audience in this country so you can create a successful social strategy. Whether you’re marketing to Gen Z or Baby Boomers, these insights will empower you to truly connect with them.

But analysing social media demographics isn’t a standalone task. Because demographics only tell part of the story, you’ll need to pair this data with insights into the audience’s interests and preferences on each platform. Additionally, since these preferences are constantly evolving, it’s important to seek out the most up-to-date data available.

To learn more about the latest social media preferences in Australia, check out the Australian edition of The 2025 Sprout Social Index™.

Share