Twitter (X) competitor analysis: The complete guide for strategic insights

Table of Contents

On X (formerly Twitter), conversations evolve in minutes. Brands that thrive understand both audience behavior and the competitive environment.

Competitor analysis provides that essential clarity. It moves you beyond assumptions and fleeting trends, giving you a grounded view of what resonates in your industry, who drives influence and how to outperform others.

This guide walks through what X competitor analysis really is, why it matters and how you can use it to elevate your social strategy on the platform.

What is a Twitter (X) competitor analysis?

An X competitor analysis is a structured review of how other brands, creators and thought leaders in your industry show up on the network. Rather than fixating on vanity metrics, it blends a quantitative look at performance data with a qualitative examination of tone, narrative patterns, hook styles and content themes.

This dual perspective reveals not only what performs well, but why it performs well. It also helps you understand how competitors participate in conversations, how audiences emotionally respond to them and what role each competitor plays in shaping discussions in your industry.

Ultimately, it gives your team a deeper, more holistic picture of the social ecosystem you share on the X network.

Why X competitor analysis is valuable for your brand

Competitor analysis matters because it reduces guesswork.

When you study how others in your industry achieve visibility, sustain engagement and cultivate loyalty, you gain clarity that is otherwise hard to access.

It shows you which content formats consistently outperform, which narratives audiences respond to and which creators or brands influence opinion in your category. In addition, benchmarking your own metrics against competitors provides the context needed to determine whether your engagement and growth are genuinely strong or simply average for your industry.

Beyond performance, competitor insights help you anticipate trends early, identify white-space opportunities and build a strategy firmly rooted in audience reality rather than assumptions. With these insights, social teams can move with confidence, make better creative decisions and elevate their content in ways that meaningfully drive results.

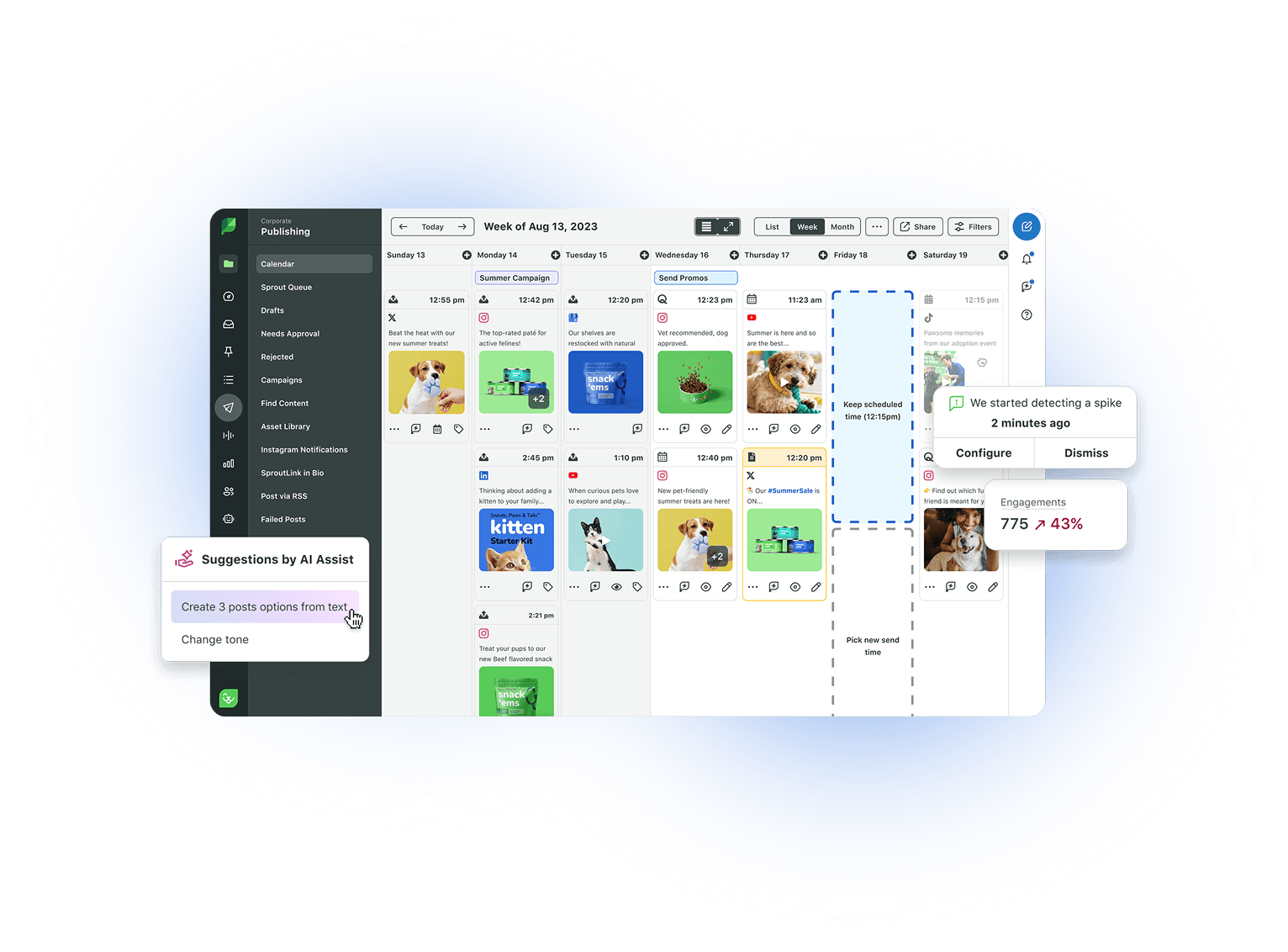

While many teams start with native analytics and manual monitoring, platforms like Sprout Social centralize competitor metrics and listening insights into a single view, making it easier to benchmark performance and see how your brand stacks up across networks over time.

What to measure in a Twitter (X) competitor analysis

To make competitor analysis genuinely actionable, it’s important to track insights that go beyond surface-level data.

The most meaningful metrics illuminate not only how competitors perform, but what drives that performance. By analyzing engagement patterns, content themes, audience growth signals and share of voice, you begin to see a fuller picture of how competitors create momentum and sustain visibility.

These metrics become the backbone of a strong X competitor analysis, helping you identify patterns, uncover opportunities and translate insights into strategic moves that elevate your own brand.

Below are the key areas to evaluate, each offering a different lens on competitor behavior and audience response.

Engagement rate and engagement quality

Understanding X engagement rate reveals how deeply a competitor’s content resonates relative to their audience size. But the quality of those interactions—such as replies, quote posts or meaningful back-and-forth conversations—gives even greater insight into the strength of their audience relationships and the emotional impact of their messaging.

Content themes, hooks and formats

Studying which themes competitors return to, which hook styles consistently capture attention and which formats (text-only, threads, videos, polls) dominate their best-performing X posts, helps you identify patterns that drive visibility. These insights reveal what target audiences are hungry for and which topics or styles may be underutilized in your industry or niche.

Share of voice on core topics

Evaluating how often competitors appear in conversations tied to industry-specific keywords or hashtags shows whose voice carries weight. It demonstrates who initiates conversations, who responds quickly to trends and who maintains the strongest presence in your category’s key discussions on X.

Follower growth and audience signals

Tracking growth over time helps you differentiate between steady, authentic momentum and short-term spikes tied to virality or promotions. Examining who follows competitors—industry leaders, creators, brand partners—also helps you understand the quality and relevance of their reach.

Posting cadence and timing

Frequency and timing reveal whether competitors take a consistent or opportunistic approach. These patterns help you understand how they maintain momentum, when their X audience is most active and how closely their posting schedule aligns with engagement peaks.

Use of X features

Competitors who make strategic use of long posts, threads, polls or series often gain algorithmic advantage. Understanding how they package information and which features correlate with their strongest posts helps you refine your own execution.

Traffic and conversion signals

Where visible, competitor CTAs, pinned posts, landing page choices and social-proof elements offer insight into how they convert attention into action. These cues help you assess how effectively they guide their followers on X toward deeper engagement.

Where a third-party X analytics tool helps with competitive analysis

Much of this analysis can be done manually, but it becomes difficult to sustain at scale, especially when you’re tracking multiple competitors, profiles and timeframes. This is where a platform like Sprout Social is particularly useful for X competitor analysis.

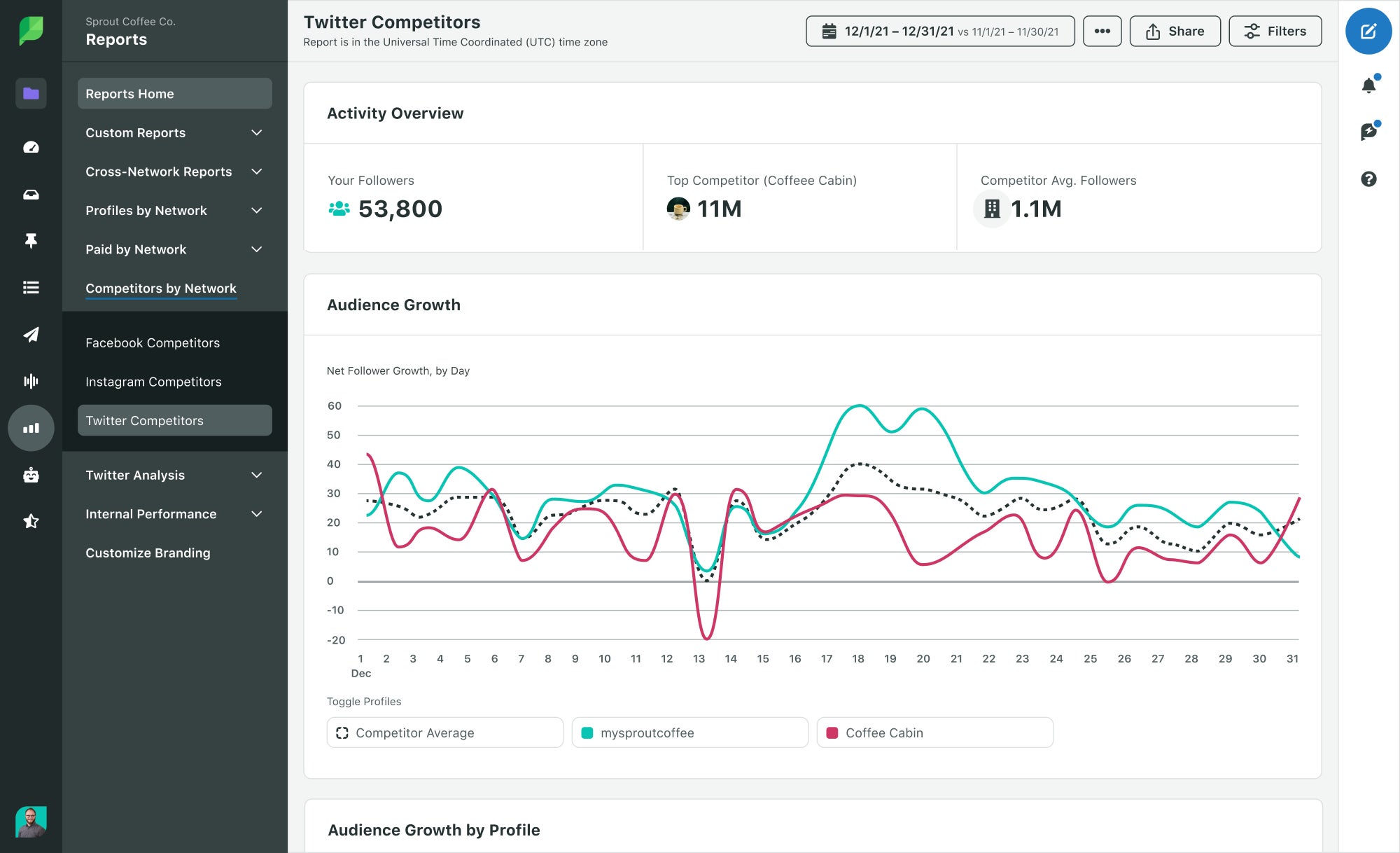

Sprout’s X (formerly Twitter) Competitors Report and broader Competitor Performance capabilities enable you to track and compare other X profiles side by side with your own. This enables you to benchmark audience growth, engagement and posting volume and stack your performance against the average of all profiles you’re analyzing.

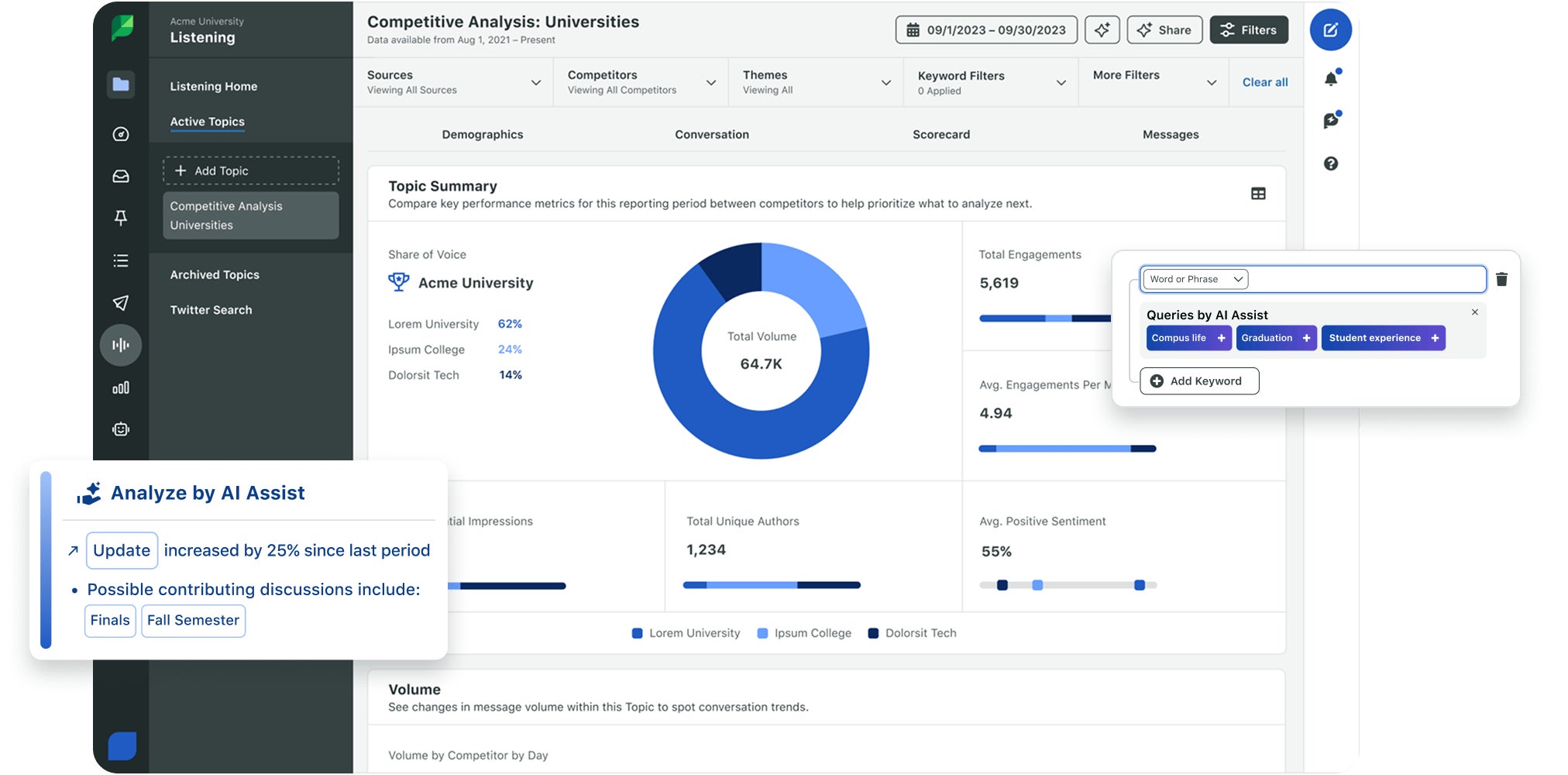

Beyond profile-level metrics, Sprout’s Social Listening tools are built to uncover why competitors are performing the way they are. You can use competitive Listening Topics to see which brands dominate conversation volume, how sentiment trends over time, which keywords and hashtags consistently drive engagement and how your share of voice compares.

Together, these capabilities move you past simple post-by-post comparisons and into a more strategic view of the X landscape: who is winning attention, what’s driving that advantage and where your brand has room to differentiate.

To see how these insights come together in one platform, schedule a Sprout Social demo.

How to perform an X competitor analysis in 11 steps

Performing a strong X competitor analysis requires more than collecting metrics. For brands, this process is about understanding both the performance dynamics of your competitive landscape and the deeper content strategies shaping audience expectations.

By using a structured, step-by-step system, you create a consistent framework for evaluating competitors and translating insights into brand-level decisions. Below is a breakdown designed for brand teams that need clarity, repeatability and strategic depth.

Step 1: Define the purpose and scope of your analysis

Before identifying competitors or collecting data, clarify why you’re conducting the analysis and what business questions you need to answer. Every brand’s relationship with X is different (e.g., real-time engagement vs. thought leadership vs. awareness). Establishing your goals upfront ensures the analysis remains focused and relevant.

For example, a brand focused on community engagement will prioritize examining competitor reply behavior, conversation patterns and tone. A brand seeking visibility might focus more heavily on posting cadence and content formats. Defining your scope early prevents collecting unnecessary data and helps you hone in on strategic insights.

Step 2: Identify your competitive set

Selecting the right competitors determines the usefulness of your analysis. For brands, this means looking beyond companies only in your sector. Include accounts that share your audience’s attention, influence your category narrative or set creative standards worth studying.

Your competitive set will typically include three groups:

- Direct competitors offering similar products or services

- Indirect competitors (i.e. media publishers or creators), who influence the conversations your audience cares about

- Aspirational competitors that exemplify strong X performance, even if they operate outside your industry

Aim for a list of five to ten accounts. This strikes a balance between breadth and depth while avoiding information overload.

Step 3: Establish a clear timeframe and data collection window

Competitor analysis is only meaningful when you compare all accounts across the same period. For brands, a standard 30-, 60- or 90-day window works well, depending on how active your industry is on X. Shorter windows capture real-time trends, while longer windows identify sustained patterns, seasonal behaviors and evergreen content.

During this timeframe, collect not just raw performance metrics, but contextual components. Save examples of high-performing posts, note campaign timing and capture recurring formats or series. These artifacts are invaluable for connecting content strategy and performance outcomes.

Step 4: Analyze competitors’ engagement and growth performance

With your timeframe established, begin evaluating numerical performance. Engagement rate is the clearest indicator of content resonance because it adjusts for audience size, offering a more accurate comparison.

As you evaluate engagement, consider both volume and quality. High likes with shallow conversation may suggest broad reach but weak community depth; steady replies and thoughtful comments reflect stronger audience trust.

Similarly, examining follower growth identifies whether competitors are gaining traction over time or relying on sporadic spikes (virality or paid promotion). This quantitative analysis sets the foundation for understanding truly effective brands versus less sustainable success stories.

Step 5: Study content themes, narrative patterns and hook styles

Brand performance on X is rarely random; successful competitors repeat resonant themes and styles. Evaluate how they package their ideas:

- What narratives do they return to (e.g., thought leadership, humor, industry insights)?

- How do they open posts?

- Which hooks consistently drive engagement (strong claims, questions, data, storytelling)?

This qualitative evaluation helps you understand the deeper architecture of competitor content. It reveals which topics drive attention, how competitors frame information and which storytelling choices connect best with shared audiences.

Step 6: Examine posting cadence, timing and channel behavior

For brands, timing and consistency can be as influential as the content itself. Examine how frequently competitors post, how they space their content and when they publish. Look for patterns in engagement peaks (morning slots, end-of-day commentary, real-time trend participation).

Also study whether competitors maintain a consistent rhythm or rely on bursts around launches and events. These behavioral signals show how disciplined their content system is and how often you need to participate to remain competitive in your industry.

Step 7: Evaluate how competitors participate in conversations

X is conversational at its core; brand presence is shaped by posting and participating. Focus on how competitors engage beyond their own posts: Do they reply frequently? Initiate conversations with creators, customers or industry leaders? Quote-post breaking news or join trending discussions?

Analyzing conversation patterns reveals which brands function as community builders, thought leaders or reactive players. This insight clarifies where your brand needs to strengthen its presence: increasing dialogue, reacting more swiftly to trends or establishing a consistent voice in industry discussions.

Step 8: Assess use of X features and format innovation

Brands that leverage network features strategically often see disproportionate returns. Examine whether competitors use long-form posts, threads, polls, video clips, media carousels or recurring series. Identify which features correlate with their highest engagement and which ones seem underutilized in your category.

This understanding helps you identify experimentation opportunities. For example, if your category relies heavily on text-only content, there may be whitespace to explore richer media. If long-form posts consistently outperform, your brand could benefit from deeper storytelling.

This step ensures your strategy reflects both network capabilities and the successful behaviors of the brands you observe.

Step 9: Identify gaps, opportunities and areas of differentiation

Once you’ve gathered performance data and qualitative insights, begin synthesizing patterns. Look for areas where competitors are strong and where they are weak. These gaps represent your biggest competitive opportunities.

For example, if competitors rarely use educational threads, your brand has space to own long-form, value-driven content. If no one runs recurring series, you have an opening for consistent brand storytelling.

The goal is not imitation but informed differentiation. Identifying these gaps creates a roadmap for content and narrative moves that allow your brand to stand out meaningfully.

Step 10: Translate insights into a brand testing roadmap

An effective competitor analysis ends with action. Based on your findings, build a short-term testing roadmap that outlines which formats, topics, tones or approaches you want to experiment with over the next four to eight weeks.

These tests should be rooted in the patterns you observed—either through modeling what consistently works in your industry or intentionally leaning into white-space opportunities competitors have overlooked.

Develop tests with clear hypotheses: Does adopting stronger hooks lead to higher engagement? Do long-form posts improve Share of Voice? Does a recurring weekly thread boost follower growth? This roadmap is the bridge between insight and execution.

Step 11: Revisit your analysis quarterly and adjust strategy

X evolves quickly; competitive behavior shifts with trends, algorithmic changes and news cycles. Treat competitor analysis as an ongoing, quarterly practice to ensure you never fall behind. Revisit your set and benchmarks quarterly, reassessing data and strategy shifts. This routine keeps your brand aligned with audience expectations and maintains a well-informed content strategy.

Turn competitive insight into strategic advantage

A thoughtful X competitor analysis helps you cut through the noise, understand the patterns of high-performing brands and translate insights into smarter decisions. When you clearly see what drives visibility and influence in your industry, you are better equipped to build content that resonates and outperforms.

If you’re ready to deepen your competitive intelligence and centralize your analysis, explore how Sprout Social can support your team. Request a free Sprout demo to see these capabilities in action.

Share