Social media demographics to inform your 2026 strategy

Table of Contents

Social media in 2026 is bigger and more spread out than ever.

Marketers searching for social media statistics need to know not just who is on each platform, but how behavior is shifting across platforms.

Where are people searching? What formats do they default to? Which platforms are they leaving, and which ones are they migrating toward?

Let’s break down the latest social media demographics across every major platform so you can build a smarter social media marketing strategy for 2026.

Social media demographics: the numbers you need to know

As of 2026, social media has reached true supermajority status.

There are around 5.66 billion active social media users worldwide, and 93.8% of all internet users now have at least one social media identity, making social platforms one of the most universal digital behaviors on the internet.

Social media is also no longer a single-platform habit. The typical user now moves between 6.75 different social networks every month. Discovery, comparison and engagement are spread across multiple platforms rather than happening in one place.

And people are spending a solid amount of time on social media: 18 hours and 36 minutes per week on average. These platforms now compete directly with streaming, search and browsing as one of the main ways people spend their time online.

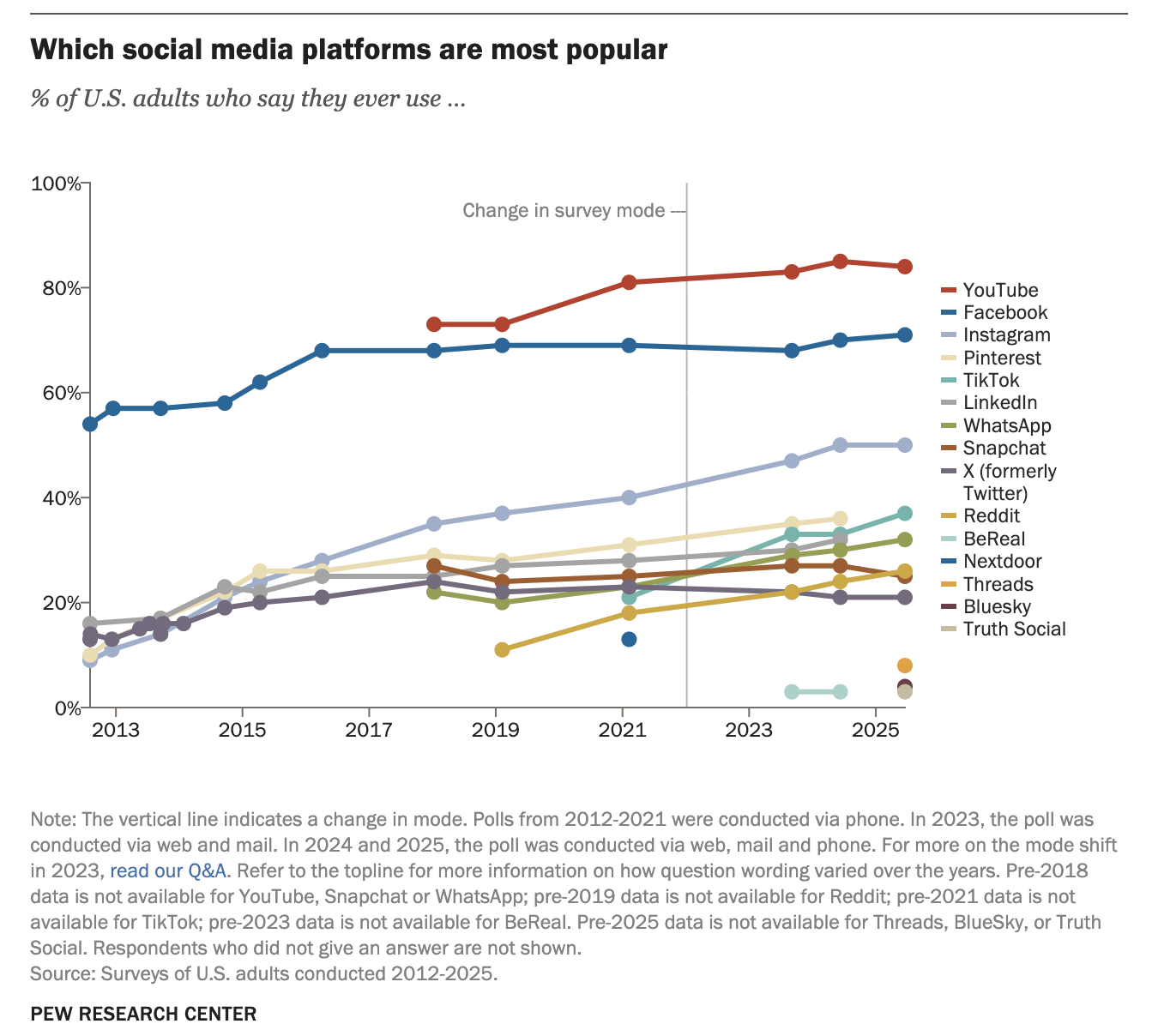

What is the most used social media platform?

Facebook continues to be the most popular social media platform globally in 2026.

However, in the US, YouTube surpasses Facebook for the most popular social media platform.

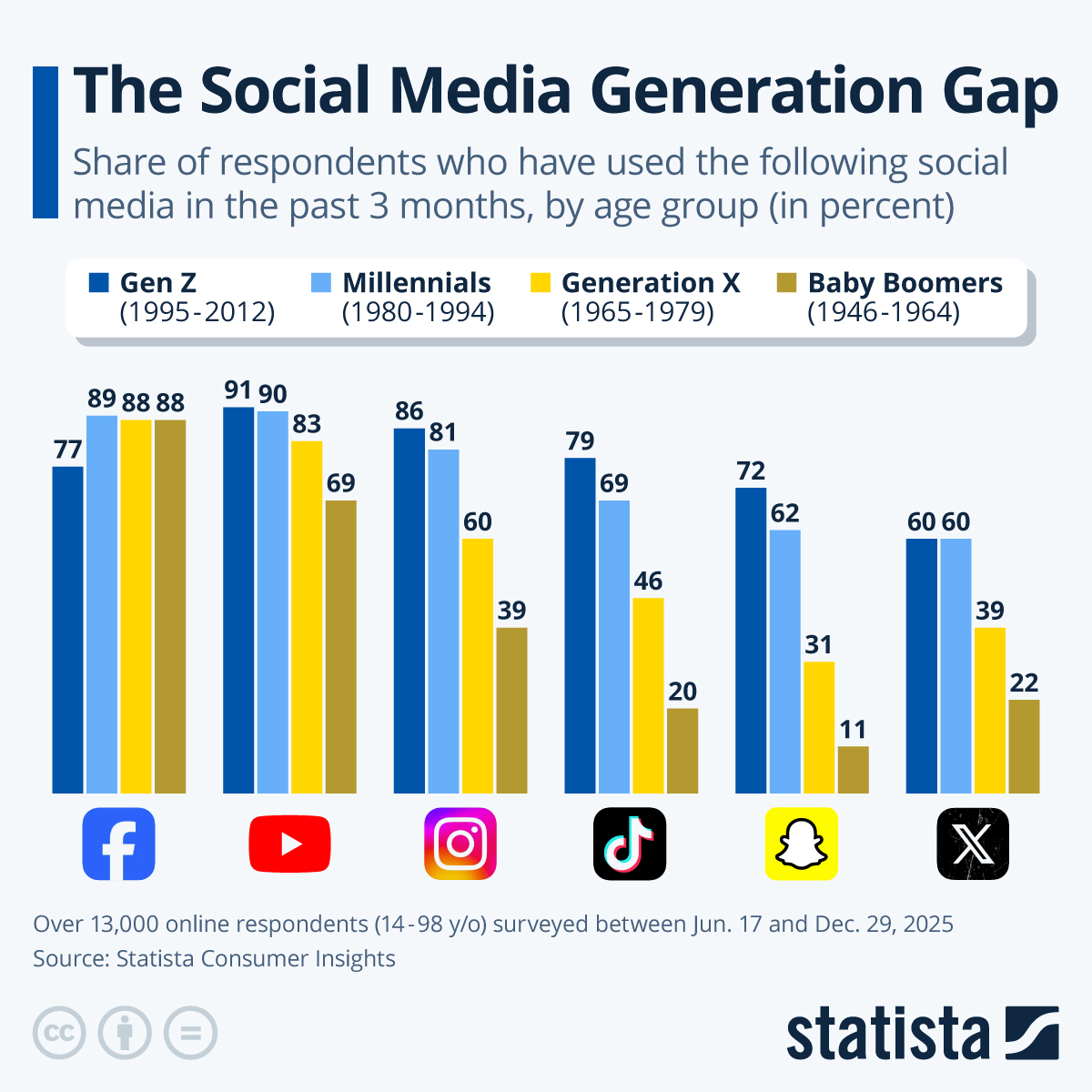

What is the most used social media by age?

Below is a breakdown of social media usage by generation worldwide:

- Gen Z: YouTube (91%), Instagram (86%), TikTok (79%), Facebook (77%)

- Millennials: YouTube (90%), Facebook (89%), Instagram (81%), TikTok (69%)

- Generation X: Facebook (88%), YouTube (83%), Instagram (60%), TikTok (46%)

- Baby Boomers: Facebook (88%), YouTube (69%), Instagram (39%), TikTok (20%)

What age range is the most active demographic on social media?

The most active age group on social media today is 16–24-year-olds. They spend the most time and show up most consistently, using social platforms on about 4.6 days each week and for roughly 3 hours and 30 minutes per day.

They’re closely followed by 25–34-year-olds, who remain a highly active and commercially important audience, spending around 4.4 days per week on social media and just under 3 hours per day across platforms.

3 Key social media demographic trends for 2026

The social media playbook from even two years ago is already outdated.

New platforms are stealing market share, search behavior is evolving and an entire generation now defaults to video-first content.

These three trends explain where attention is actually going in 2026.

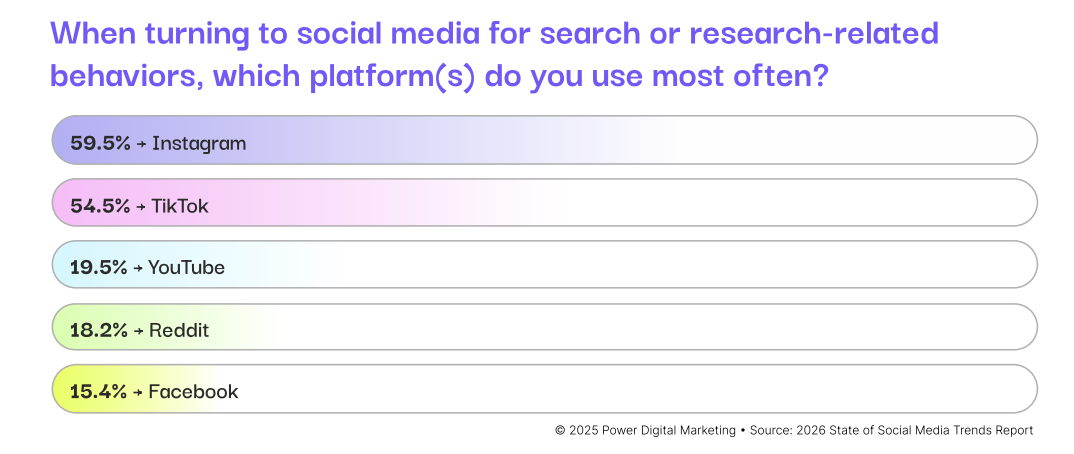

Social search as an alternative to Google

According to the Sprout Social Q2 2025 Pulse Survey, social platforms are becoming the primary search engine for younger generations. Among Gen Z, 41% now turn to social media first when looking for information, compared to just 32% who prioritize Google or traditional search engines.

That gap is driven by a desire for human validation. The Sprout Social Q3 2025 Pulse Survey found that 52% of social media users prefer social search over AI chatbots specifically to find user-generated content and personal experiences.

Trust is shifting alongside behavior. Among Gen Z, 52% say they are more likely to trust brand or product information found on social media compared to information found through other forms of search like Google or AI chatbots.

For younger audiences especially, search rarely starts with a browser. It starts in a feed. While Facebook is a top social media channel for product discovery at 39%, roughly 49% of Gen Z uses TikTok specifically for product discovery. If your brand isn’t optimized for social discovery, you’re invisible to the people doing the searching.

The fragmentation of X (Twitter)

In January 2026, Threads reached 141.5 million daily active app users, officially surpassing X’s 125 million—a milestone that would have been unthinkable just a year earlier.

Bluesky, though much smaller at around 42.5 million total users, has carved out a loyal niche among users who left X over concerns about content moderation and data policies.

For marketers, X is no longer the default microblogging platform. Audiences are now scattered across at least three competing social networks, and the smartest brands are diversifying their presence accordingly.

Short-form video as default

Still thinking short-form video is just a trend? It’s not. It’s the baseline.

Research shows over 90% of US Gen Z and Millennial users watch short-form content frequently or sometimes across platforms like TikTok, YouTube and Instagram.

This isn’t just passive scrolling either. Over half (59%) of Gen Z use short-form video apps to discover content before seeking out longer versions elsewhere.

If you’re still leading with static images or long-form blog content on social, you’re speaking a language your audience has already moved past.

Facebook demographics and usage

- Number of monthly active users: 3.070 billion

- Largest age group: 25-34 (32%)

- Gender distribution: 43% female, 56.6% male (no data on other genders)

- Avg. time spent per day: 67 minutes

Takeaways from Facebook demographics for 2026

- Build your primary creative and messaging around the 25–34 life stage, not just age targeting. This group responds best to content that solves practical problems, saves time or money, and shows real-world usage. Prioritize demos, before/after scenarios and customer stories over brand storytelling.

- That slight male skew is less meaningful than watching what content actually drives reactions, comments and shares. Use Facebook analytics to map post types against demographic slices so you know exactly what resonates with who and when.

- The Sprout Social 2026 Content Strategy Report shows Facebook is the top platform for both product discovery and customer support. Make sure your Page, pinned posts, FAQs, comments and DMs are built to answer buying questions quickly and reduce hesitation.

- Facebook users interact most with short-form video (48%). Use this format to grab attention and spark interest, then follow up with text posts that clarify details and use cases so users can confidently move toward purchase.

Learn more about other vital Facebook statistics to prepare your 2026 strategy.

Instagram demographics and usage

- Number of monthly active users: 3 billion

- Largest age group: 25-34 (33.3%)

- Gender distribution: 52.5% male (no data on other genders)

- Av.g time spent per day: 73 minutes

Takeaways from Instagram demographics for 2026

- Instagram’s audience has shifted upward into a more commercially valuable age group. For marketers, this makes Instagram stronger for mid-to-bottom funnel campaigns, especially for lifestyle, ecommerce and SaaS products aimed at young professionals.

- The 25-34 age group also responds strongly to brands that reflect how they work, live and spend. Anchor your creative in realistic scenarios, customer stories and creator-style formats instead of campaign-style visuals.

- Instagram users are spending significantly more time inside the app. It’s a good time to invest in more layered content strategies such as creator partnerships and episodic Reels instead of relying on only single-post launches.

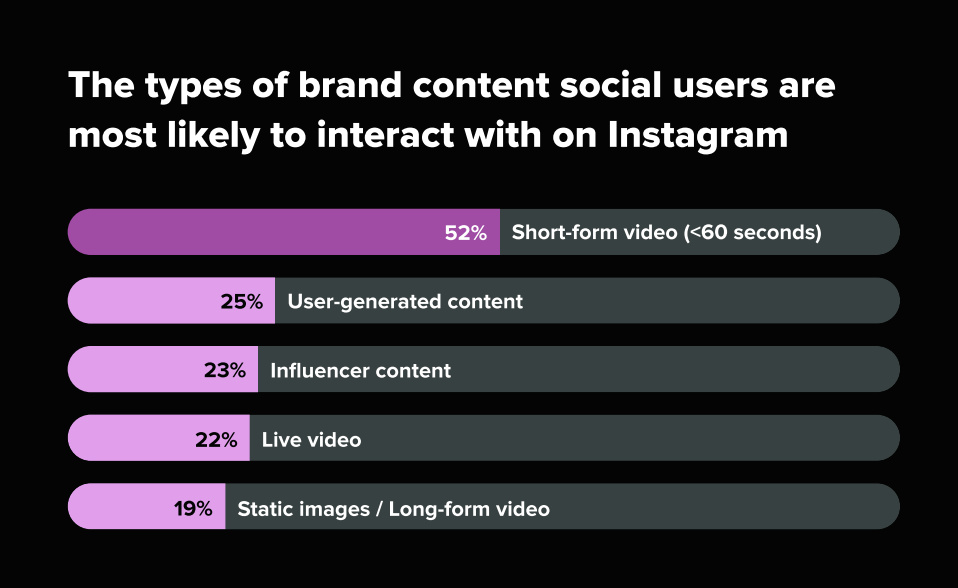

- Instagram users are more likely to interact with short-form video than any other post type, so Reels should be your go-to format. Plan your posts as vertical video first, and then repurpose into carousels and Stories for deeper context and saves.

- With 72% of Gen Z preferring Instagram for customer care, your DM workflows, story replies and comments directly influence conversion and retention. Brands that respond quickly with product links, sizing help or guidance will outperform brands that treat support as a separate channel.

Learn more about other vital Instagram statistics to prepare your 2026 strategy.

TikTok demographics and usage

- Number of monthly active users: 1.99 billion

- Largest age group: 25-34 (40.3%)

- Gender distribution: 45.5% female, 54.5% male (no data on other genders)

- Avg. time spent per day: 97 minutes

Takeaways from TikTok demographics for 2026

- Build for the 25–34 audience with “adult utility.” Practical demos, problem-solving, comparisons and behind-the-scenes often land better than trendy content that does not connect to a real-life need.

- Because time spent is high, your biggest risk is slow pacing. Cut intros, front-load the outcome and surface the benefit in the initial seconds so viewers commit early.

- With most users saying they come to TikTok for funny or entertaining content, even product or B2B brands need to package education inside light, creator-style delivery. Straight ads or polished brand videos are less likely to hold attention.

- Since 49% of Gen Z users turn to TikTok for product discovery, your content must clearly show what the product is, who it is for and how it fits into everyday life within the first few seconds. Discovery clips should always link to deeper proof and buying paths.

Learn more about other vital TikTok statistics to prepare your 2026 strategy.

X (formerly Twitter) demographics and usage

- Number of monthly active users: 557 million

- Largest age group: 25-34 (37.5%)

- Gender distribution: 35.4% female, 64.4% male (no data on other genders)

- Time spent per day: 28 minutes

Takeaways from X demographics for 2026

- X remains a focused, high-intent touchpoint rather than a long-form engagement platform. Daily time spent has edged down to 28 minutes, reinforcing that X works best for fast consumption, updates and commentary, not extended storytelling.

- The gender skew remains pronounced. Nearly two-thirds of Twitter’s audience is male, which is why brands in technology, finance, sports and policy-adjacent categories often see stronger organic traction here than lifestyle-led brands.

- With 58% of X users engaging with brand content each week, performance comes from steady participation in relevant conversations rather than campaign-only posting.

- A platform known for text-first conversations now sees 37% of users engaging most with short-form video, compared to 36% with text posts. If your strategy is still only Twitter threads and written commentary, you’re likely losing reach.

Learn more about other vital Twitter statistics to prepare your 2026 strategy.

YouTube demographics and usage

- Number of monthly active users: 2.580 billion

- Largest age group: 25-34 (21.3%)

- Gender distribution: 47% female, 53% male (no data on other genders)

- Avg. time spent per day: 85 minutes

Takeaways from YouTube demographics for 2026

- With daily usage at nearly 1.5 hours, YouTube is a prime channel for education and brand influence. If your product needs context, setup guidance or proof, it’s one of the few platforms where audiences will actually stay long enough to consume it.

- Relevance matters more than identity targeting. The gender split remains close (46% female, 54% male), which means you’re more likely to see success with content aligned to use cases and problems over gender-based creative.

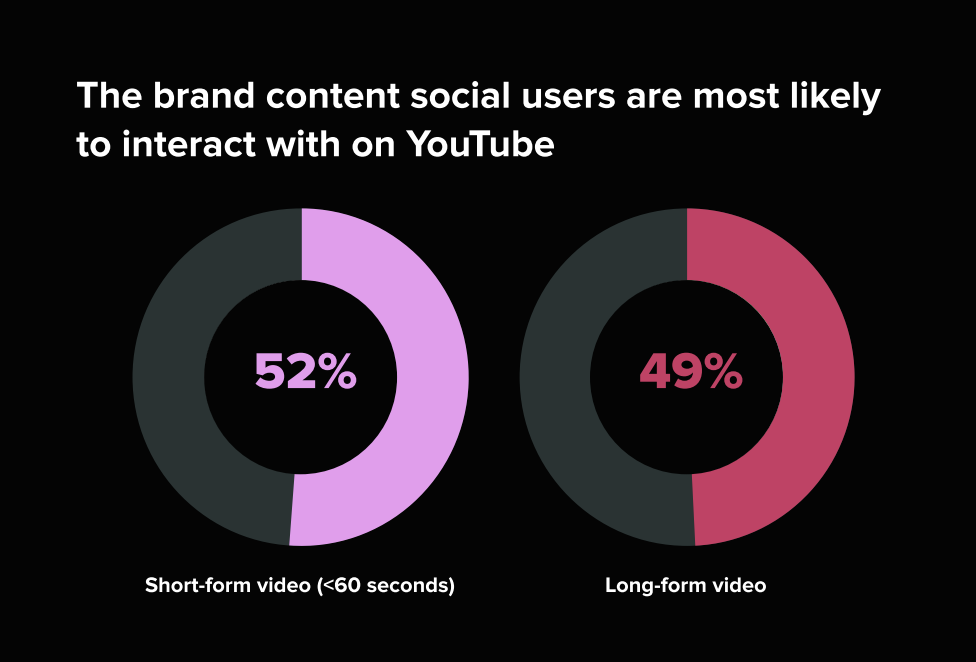

- Since slightly more users prefer videos under 60 seconds, Shorts are a great way to capture interest, introduce products and tease use cases before directing viewers to longer-form explainers.

- YouTube is 1.6x more likely to influence purchase decisions than other social platforms. This means it should carry your strongest commercial messaging. Invest in structured demos, buyer guides and competitive breakdowns to help buyers commit.

Learn more about other vital YouTube statistics to prepare your 2026 strategy.

LinkedIn demographics and usage

- Number of members: 1.3 billion

- Largest age group: 25-34 (33.4%)

- Gender distribution: 43.2% female, 56.8% male (no data on other genders)

- Avg. visit duration: 6 minutes

Takeaways from LinkedIn demographics for 2026

- LinkedIn’s audience is becoming more balanced across career stages. The largest age group (25-34) shifted from 50.6% to 33.4% this year. We recommend creating content for both early-career and decision-level audiences.

- Attention on LinkedIn is brief and highly selective. With shorter per-visit time and feeds crowded with AI posts, it’s harder than ever to stand out. Your content needs stronger hooks and clear, practical takeaways, or it will be skipped.

- B2B marketers ranked LinkedIn as their most-used platform in 2025, which means competition is increasing. Brands must differentiate through proprietary data, real-world experience and helpful guidance.

- Because text posts on LinkedIn significantly outperform UGC, images, video and influencer content, thought leadership posts and short, insight-driven narratives should anchor your content strategy.

Learn more about other vital LinkedIn statistics to prepare your 2026 strategy.

Pinterest demographics and usage

- Number of monthly active users: 619 million

- Largest age group: 25-34 (31.6%) globally

- Gender distribution: 70% female, 22.8% male, 7.2% unspecified (no data on other genders)

- Time spent per day: 10 minutes

Takeaways from Pinterest demographics for 2026

- Pinterest’s monthly users increased from 553M to 600M, showing renewed growth and making the platform more relevant for long-term brand discovery strategies.

- Pinterest’s audience remains highly skewed toward women and planning-oriented users. With 70% female users and the largest group now in 25–34, Pinterest is particularly strong for home, fashion, wellness and family-related categories.

- Brand discovery on Pinterest happens before brand preference is formed. Since 96% of top searches are unbranded, your content should target category-level needs and problems rather than brand-led messaging.

- Pinterest reaches 40% of US households earning over $150K, which makes this platform especially valuable for premium and luxury products.

Learn more about other vital Pinterest statistics to prepare your 2026 strategy.

Snapchat demographics and usage

- Number of daily active users: 474 million

- Largest age group: 18-24 (35.4%)

- Gender distribution: 48.4% female, 50.7% male (no data on other genders)

- Time spent per day: 17 minutes

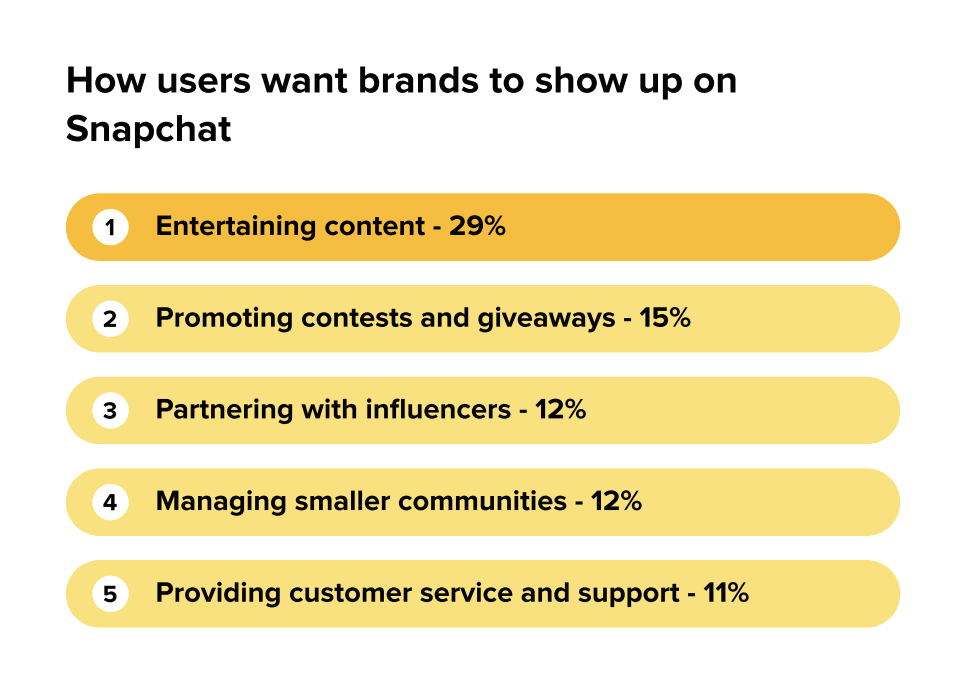

Takeaways from Snapchat demographics for 2026

- Snapchat is still very much a Gen Z space. People are opening the app for quick, personal moments, not brand stories. Your content needs to feel native and informal. Think short, entertaining and designed to blend into how friends already communicate.

- Broad targeting rarely works well here. Usage drops sharply outside younger age groups, which is why Snapchat performs best when campaigns are built specifically for youth interests, language and culture, rather than reused from Instagram or TikTok.

- More than 300 million people use Snapchat’s AR features every day. Lenses and try-on formats are a practical way to drive product understanding and interaction, especially for fashion, beauty and consumer brands.

- There’s an obvious opportunity gap for brands. About 75% of Gen Z and Millennial users interact with brand content weekly, yet only 30% of companies actively use Snapchat. Early movers can still build familiarity here before it gets saturated.

For a deeper dive into usage and trends, explore more Snapchat statistics to inform your strategy.

Reddit demographics and usage

- Number of daily active users: 116 million

- Largest age group: 18-34 (37%) (US audiences only)

- Gender distribution: 39.4% female, 60% male (no data on other genders)

- Time spent per day: 19 minutes

Takeaways from Reddit demographics for 2026

- Reddit has become much more mainstream than it was just a year ago. Daily active users jumped to 116 million, up 19% from last year. Reddit is now a hot spot where people actively research, compare and ask for authentic opinions.

- Reddit may skew male overall, but that’s not how the platform works. The most value comes from niche subreddits with very specific audiences. Focus on the communities your buyers actually use, rather than trying to reach Reddit as one big platform.

- Around 18.2% of users actively use Reddit for research, which is more than Facebook. Brands that contribute to comparison threads, buying advice discussions and AMA-style conversations can directly influence decisions.

- While 21% of users want brands to show up mainly for customer support, 14% do not want brands there at all. Brands must earn their place in conversations. The safest way to do this is by solving problems openly and transparently.

Learn more about other vital Reddit statistics to prepare your 2026 strategy.

Threads demographics and usage

- Number of monthly active users: 400 million

- Largest age group: 25-34 (28.75%)

- Gender distribution: 57.85% male, 42.15% female† (no data on other genders)

- Time spent per day: 4 minutes

Takeaways from Threads demographics for 2026

- Threads is growing fast, but it’s still a light-touch platform. With only 4 minutes of daily usage, people dip in quickly to check what is happening. This is not where you explain your product in depth. It’s where you build voice, visibility and familiarity.

- Threads is like a natural extension of your Instagram presence, which means its audience is very similar to core IG users. Your tone, cultural references and storytelling style should stay aligned across both platforms.

- Keep your content fast and simple. Threads users are most likely to engage with short videos and text posts from brand accounts, so quick tips and explainers work better than polished campaign content.

- Only 12% of marketers currently use Threads, so there’s still a first-mover advantage here. Brands have a rare window to experiment and build presence before competition increases. Interestingly, Sprout Social’s research found that 45% of marketers plan to invest more resources into Threads in 2026.

Bluesky demographics and usage

- Number of active users: 40 million

- Largest age group: 25-34 (30.55%)

- Gender distribution: 61.7% male, 38.3% female (no data on other genders)

- Average visit duration: 5 minutes and 47 seconds

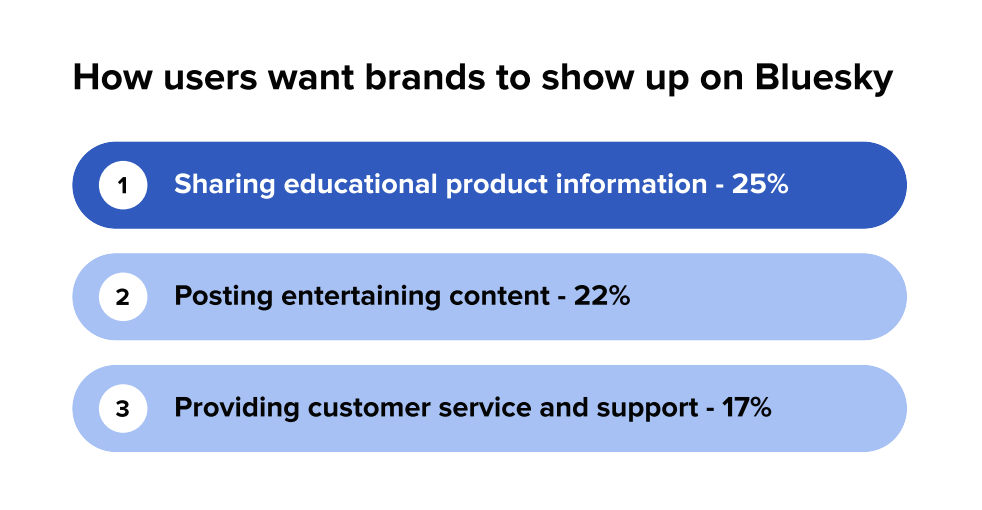

Takeaways from Bluesky demographics for 2026

- Bluesky is still very early-stage and highly concentrated. It’s best treated as a place to learn, listen and test how your brand voice fits into emerging communities.

- Helpfulness is the fastest way to build credibility on Bluesky. Sprout’s research shows Bluesky users expect brands to focus first on product education, followed by entertainment and customer support.

How to use social media demographics in your 2026 strategy

Demographics tell you where your audience is. But true success comes from using that data to build strategies around specific personas, not just platform checklists.

Start by mapping your ideal customer profiles against the platform breakdowns above. Instead of asking “should we be on TikTok?” ask something like “where does our 28-year-old operations manager go when they’re comparing tools?”

That answer might be:

- Reddit for peer opinions

- YouTube for product demos

- LinkedIn for thought leadership

One person, three platforms and three different content needs.

From there, match your content format and tone to how people actually behave on each platform. A short-form video that performs well on Instagram Reels won’t land the same way as a text post on Threads or a detailed reply in a Reddit thread.

The demographic data tells you who’s there, but the behavioral data tells you what they expect when they show up.

Instead of being everywhere, show up where your specific audience is most active and most open to hearing from you, with content that fits how they already use that platform.

Future-proof your social strategy with demographic data

With the largest reach, Facebook and YouTube are where the majority of users across every generation spend their time, and they’re still essential for awareness.

But reach alone doesn’t build trust or close deals. More and more, high-intent conversations are happening on platforms like Reddit, Threads and even LinkedIn.

A strong strategy accounts for both. Use high-reach platforms to stay visible and fuel discovery. Use niche platforms to build credibility, answer questions and drive decisions.

This guide gives you a solid starting point, but your audience is unique.

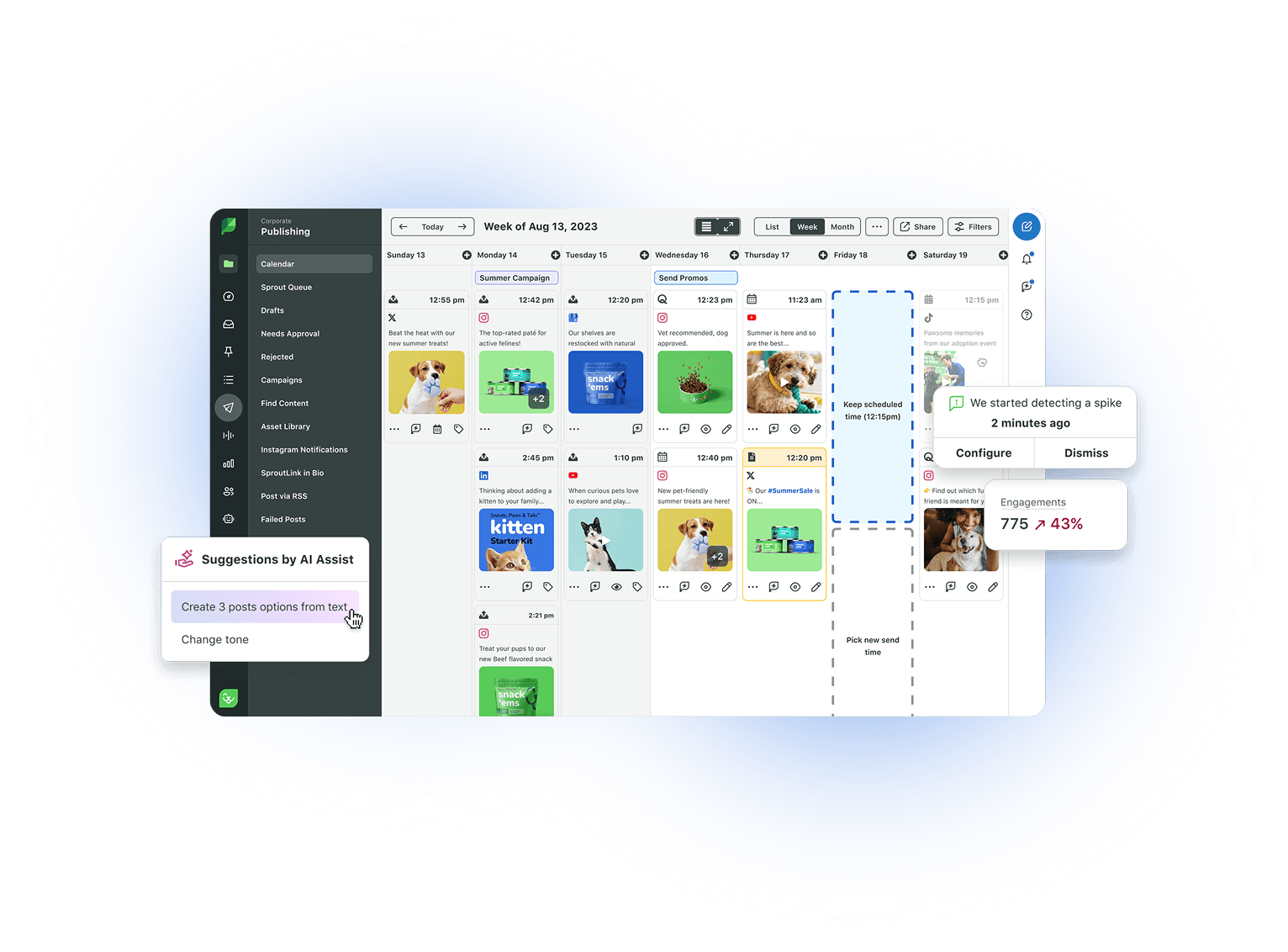

Start a free trial of Sprout Social to track your own audience demographics across platforms, see which content gets the most engagement and build a strategy based on your data instead of industry averages.

Share