Social media marketing for UK fintech: How to build trust and stay compliant

Table of Contents

Social media engagement offers UK fintech marketers a golden opportunity to build trust with their target audience and stand out from the competition.

But that opportunity also presents a unique and critical challenge. In the highly regulated world of fintech, every Tweet, Reel, Facebook post and LinkedIn carousel must meet stringent compliance standards. Marketers must determine how to drive creativity without crossing regulatory lines.

The key to striking that balance is precision. It requires understanding relevant regulations and building workflows that support the creation of compliant content that is engaging and high-performing.

Why social media marketing for fintech matters

The 2025 Sprout Social IndexTM UK Edition reveals that 91% of UK consumers use social platforms to follow trends and cultural moments, and they expect brands to be active participants in these conversations. The shift is undeniable: as The Financial Times explains, nearly half of UK investors now look to social media, influencers and AI when making financial decisions, meaning B2C fintech brands can’t afford to ignore these channels.

For these brands, social media cannot be a static digital billboard for company updates. It must work as a dynamic platform for connecting with audiences, forging trust and delivering timely, relevant financial education. When done right, this approach strengthens credibility and deepens relationships.

Beyond content, this requires a focus on several key pillars, particularly consumer trust and transparency.

Consumer trust and transparency are foundational

Trust is the foundation of every fintech relationship. Financial institutions are asking people to hand over money and personal data, which they’ll be less willing to do if a brand comes across as evasive or unclear. Social media is a powerful channel for fintechs to show transparency, openness and accountability in real time.

And expectations are high. According to the Sprout Social IndexTM mentioned above, 94% of consumers expect brands to step up their efforts against online misinformation. For fintech brands, where a single misleading claim can trigger regulatory action and put customers’ money at risk, the stakes are even higher.

Social media is an ideal place to demonstrate trustworthiness through clear communication and consumer education. Fintech brands can do this by offering accessible content in the following ways:

- Avoiding jargon-filled promises and hard sells

- Using inclusive, accessible language that meets WCAG standards

- Prioritizing clarity when explaining products or features

This approach positions your brand as a credible authority—exactly the kind of voice customers look for when choosing a financial partner.

What regulations govern fintech content in the UK?

Fintech social media is a regulated communication channel. Every post must meet the strict standards set by the Financial Conduct Authority (FCA) and other regulators. That means content marketing teams must consider compliance before hitting publish.

Compliance disclaimer: The following guidelines are for informational and strategic purposes only and do not constitute legal advice. You must consult your in-house compliance and legal teams before publishing any content.

To keep fintech social media marketing campaigns compliant, companies must adhere to these key regulations:

- Financial Conduct Authority (FCA):

- Make sure all financial promotions are fair, clear and not misleading.

- Include appropriate warnings for high-risk products.

- Seek approval from an FCA-authorised firm before publishing certain content.

- Make sure claims that reference Open Banking integrations are accurate and transparent.

- General Data Protection Regulation (GDPR):

- Obtain explicit consent before using personal data for targeting or remarketing.

- Store, process and use customer data in line with GDPR standards.

- Advertising Standards Authority (ASA):

- Ensure all financial advertising is transparent, honest and not misleading.

- Make critical exceptions and qualifications explicit.

- Avoid creating misleading impressions, such as overstating returns.

The ability to be innovative and compliant simultaneously is a strategic advantage. Start by coordinating with your legal team to ensure all parameters are met.

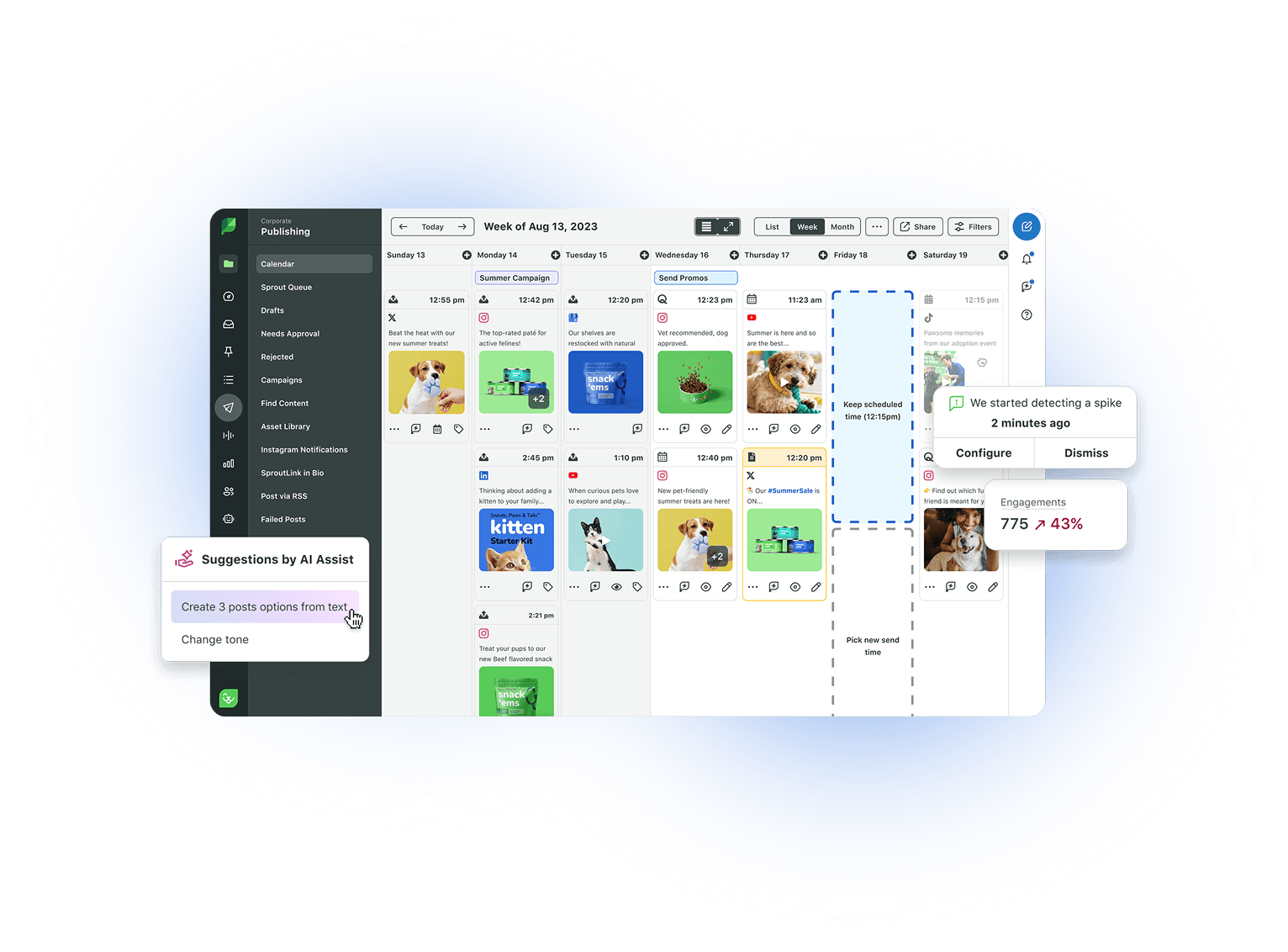

Then the right social media management software helps you establish effective workflows, which allows your legal counsel to review and approve content quickly. With this integrated approach, you can create with confidence instead of holding back. Knowing any issues will be flagged early frees you to innovate, turning regulatory adherence into a competitive advantage.

Working with finfluencers: Legal risks and best practices

Finfluencers (financial influencers) can be powerful voices for reaching new audiences, but you must handle these partnerships with care to remain compliant with FCA regulations.

To help protect your brand, collaborate with influencers who have a proven track record of creating responsible, accurate content. Provide them with pre-approved copy and visuals, maintain an auditable record of every post and verify everything with your legal counsel.

How to build a fintech social media marketing platform strategy for trust and engagement

As Europe’s largest fintech hub, competition is fierce for UK brands. Choosing the right social media networks and content formats separates the standout brands that build trust and authority from those that get lost in the noise.

Each social network contributes in a unique way to a winning fintech social media strategy that prioritises transparency, compliance and engagement:

LinkedIn: Trust-building and professional positioning

LinkedIn is where professionals go to network and stay current on industry news and trends. As a hub for professional conversations, it’s a critical social network for both fintech startups and established financial institutions looking to demonstrate and maintain authority.

According to Sprout’s 2026 Social Media Content Strategy Report, LinkedIn users want brands to share educational product information and updates from company leadership. They’re less interested in influencer content and videos—they want companies to share text-based posts to increase trust and understanding.

This LinkedIn Live event by Zilch is a great example. In it, Zilch’s founder breaks down complex ideas around AI and card payments in a way that’s easy to understand.

Source: LinkedIn

This desire for educational content makes LinkedIn ideal for demonstrating transparency, establishing thought leadership and building B2B credibility. Through case studies, explainers and infographics, you can position your brand as a trusted voice in the fintech industry.

TikTok: Short-form video for awareness and education

Many fintech marketing teams still dismiss TikTok as too playful for a regulated industry. While the app is well-known for TikTok trends and dance challenges, audiences also turn to it for financial education. The hashtag #FinTok has become popular for finance content that breaks complex topics into short, digestible clips.

TikTok also provides an opportunity to build brand awareness among younger audiences in the UK. As the 2026 Social Media Content Strategy Report reveals, 72% of Gen Z are on the app and rank it as their top channel for discovering products.

For fintech brands, this means producing 15–30 second explainers, financial mythbusters and behind-the-scenes content that show financial concepts in action. Done right, TikTok builds credibility by educating rather than selling.

For example, Monzo created a short explainer on how to use your Monzo card when you’re abroad.

Source: TikTok

As the 2025 Content Benchmarks Report shows, fewer than a quarter of financial services are on TikTok. That means fintechs that show up now can claim attention before the space fills up.

Instagram: Visual storytelling and community engagement

Instagram allows fintech brands to go beyond product talk by using storytelling to showcase their values, personalities and ways they can help.

The platform has a range of engagement tools for creating compelling narratives. Reels are great for simplifying financial tips, Stories with polls or quizzes can encourage two-way conversations and carousel posts are ideal for breaking down complex features.

To build a strong presence in financial services, start by focusing on the content formats Instagram users prefer. According to Sprout’s 2025 Content Benchmarks Report, 54% of financial services Instagram content consists of single image posts, and 25% consists of single videos. These numbers support the idea that short-form videos and static images perform well.

Maintaining a steady flow of compliance, on-brand content is much easier with streamlined approval workflows. Platforms like Sprout simplify reviews, helping you reduce social media compliance risks so you can move faster without sacrificing trust.

Facebook: Multiformat hub for established customer bases

Given that 81% of financial services brands are on Facebook and 83% of all social users have a Facebook profile, the network remains a core channel for brands. Most commonly used by millennials, Gen X and older generations, Facebook allows brands to connect with audiences who likely already have experience with financial services. For fintech companies, it’s less about visuals and more about offering an extra hub for support.

Facebook Groups are an essential part of this strategy. They give fintech brands a direct line to potential customers by providing ongoing support and establishing communities where users can share experiences. Also, Live Q&As are effective for answering common questions, explaining new features or addressing regulatory changes as they come up.

By treating Facebook as a service channel as much as a marketing one, fintechs can build trust, reduce customer friction and strengthen long-term loyalty.

YouTube: Deep-dive fintech educational content and thought leadership

YouTube is the best platform for fintech brands to go deep. While TikTok and Instagram thrive on quick content, YouTube is known for its ability to explain, educate and establish lasting authority.

Tutorials, animated explainers and expert interviews work exceptionally well for unpacking complex topics like payments, compliance or investment basics. These formats give fintechs room to break down technical subjects while showcasing expertise.

GoCardless takes advantage of this opportunity with a podcast series featuring financial experts.

Source: YouTube

According to Sprout’s 2026 Social Media Content Strategy Report, 52% of YouTube users engage most with short-form videos, while clips of >60 seconds are slightly less popular. This provides flexibility for pairing in-depth explainers with shorter highlight videos to capture different audience needs.

There’s also an added bonus: long-term SEO value. YouTube content can keep attracting potential customers long after it’s published, turning one video into a lasting trust-builder.

X (formerly Twitter): Real-time updates and brand positioning

X connects the fintech sector to real-time conversations. According to Sprout’s 2025 Content Benchmarks Report, 75% of financial services brands are already on and see higher engagement there than on any other social network. For fintech marketing teams, that makes it indispensable for industry commentary, event coverage and timely updates on regulations or product features.

Funding Circle demonstrates this by regularly posting announcements and company news.

Source: X

The 2026 Social Media Content Strategy Report shows that consumers want to be entertained on X, especially with short-form videos, and they want brands to provide customer support. To meet these expectations, brands need to balance customer service with engaging, value-driven fintech social media posts.

Formats like X threads, live updates and explainer graphics also perform particularly well. With the right tone of voice, X can help fintechs build credibility, showcase transparency and grow brand awareness.

What social media content resonates in fintech—and what doesn’t?

Even with a strong brand voice, fintechs face another challenge on social: low engagement. According to the 2025 Content Benchmarks Report, financial services content averages only 32 inbound engagements per day, with just 8 engagements per post.

The takeaway is clear: Every post needs to hit the right note by being clear, engaging and compliant. Here’s what social users expect from fintech posts:

Communicate with clarity, not jargon

Clarity is paramount for fintech brands. Communicating in simple language isn’t just about style. It’s a compliance safeguard under FCA rules. That means you have to strip away the jargon, avoid overclaims and ensure content is accessible.

Consider Starling Bank’s holiday scam checklist. It simplifies financial topics in plain, helpful language. That level of clarity builds trust and simplifies compliance audits.

Source: Instagram

Tools like Sprout’s Publishing approval workflows help maintain a consistent, jargon-free tone across teams and content types by automatically routing creative to relevant approvers. And with the Message Activity Log, you have an auditable trail of every piece of customer-facing content.

Share stories over statistics

People connect with people, not numbers. While data backs up credibility, stories make that data relatable.

Zopa nails this in an Instagram post that pairs otherwise dry YouGov data with an engaging Reel about Brits waiting months to ask for repayment. The post then reveals the solution: using the Zopa app to track spend and get your money back sooner. By creating a relatable story around the statistics, potential customers can imagine themselves in that scenario.

Source: Instagram

Finding these kinds of stories starts with listening. With Sprout’s Listening and Premium Analytics (paid add-ons), you can surface customer insights and recurring themes that align with your brand to help put a relatable spin on uninspiring financial data.

Break fintech stereotypes with creative partnerships

Fintech doesn’t have to be cold and corporate. Partnerships with lifestyle, gaming and retail brands can expand reach and make the industry feel more relatable without sacrificing compliance.

Noda provides a great example. The brand partnered with Wargaming to launch instant open-banking payments within games. By showing up where audiences already are, Noda demonstrates both innovation and credibility among its target audience.

Source: LinkedIn

To find partnerships that work with your financial brand, try Sprout’s Influencer Marketing solution. It helps you discover and vet potential partners to ensure campaigns align with your brand values, compliance needs and audience expectations.

8 fintech social media strategies your brand can borrow

The best UK brands mix creativity with credibility, proving you can educate and engage while staying on the right side of FCA rules.

Here are eight strategies you can adapt for your own campaigns:

1. Explainer content about how your brand helps customers

Finance is full of jargon, but customers want clarity—and the FCA requires it.

Social media offers a way to explain complex ideas, like open banking or savings types, in plain English. Infographics, carousels and short videos are effective formats for making this information engaging.

Moneybox does this very well, posting video interviews with financial experts who break down complex ideas so anyone can understand.

Source: Facebook

Using clear, easy-to-digest education on social media fosters trust and credibility for fintech brands. But to stand out, you also need to encourage engagement.

2. Gamified campaigns and giveaways

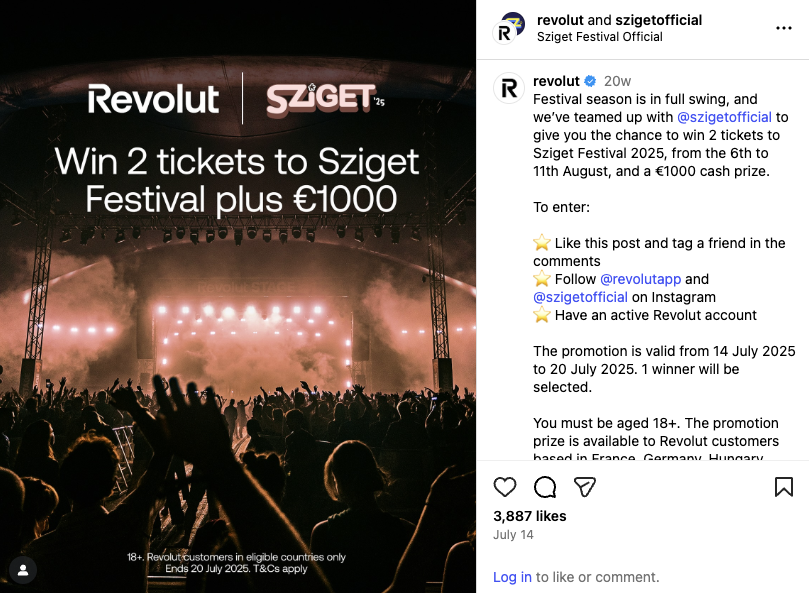

Polls, quizzes and challenges that feature clear, fully compliant prizes can help drive participation.

For example, Revolut partnered with Sziget Festival to give away two tickets, plus €1,000, using transparent T&Cs to maintain FCA compliance.

Source: Instagram

Campaigns like these make financial brands feel more accessible and spark shares and organic reach.

3. Customer journey storytelling

Narratives resonate more than product stats. Rather than use numbers to tell customers how you can help, show customers your value by solving a pain point.

For example, Creditspring recently posted a carousel that addressed a common issue for many people: getting better with money. It then pointed followers to a clear solution—its new Learning Academy.

Source: Instagram

By focusing on the customer’s challenge first and then demonstrating how its tools help, Creditspring transformed an ordinary product update into relatable content that showcases its value.

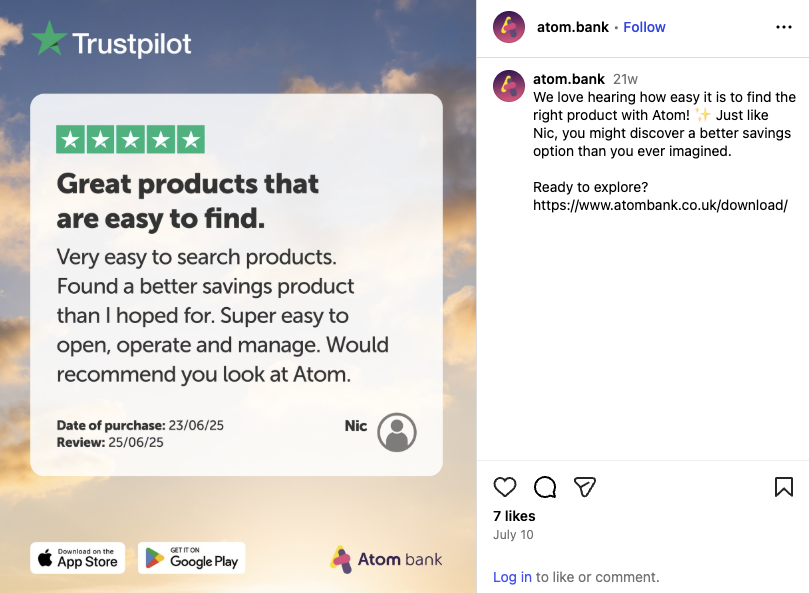

4. User-generated content campaigns

Inviting customers to share their wins builds trust. Authentic voices offer social proof of the value you bring.

Atom Bank does this by sharing customer reviews as graphics, reinforcing credibility and building connections with its audience.

Source: Instagram

You can find relevant user-generated content (UGC) using social media listening—even if you aren’t tagged. Through the Smart Inbox, you can manage all mentions in one place, route posts for approval and tag posts (such as “Approved FCA Content”) before they go live.

5. Show your fintech in the moments that matter

Fintech isn’t just about numbers. It’s about making real life easier to manage.

Remitly’s partnership with AfroFuture highlights how money transfers connect people across cultures, weaving the brand naturally into a lifestyle and community setting. By tapping into moments the target audience cares about, Remitly shows how it fits into everyday life without overselling.

Source: Instagram

The key is finding the right partners for your brand. Demo Sprout’s Influencer Marketing solution to find and vet partnerships that can showcase your brand’s products and value in real-life contexts.

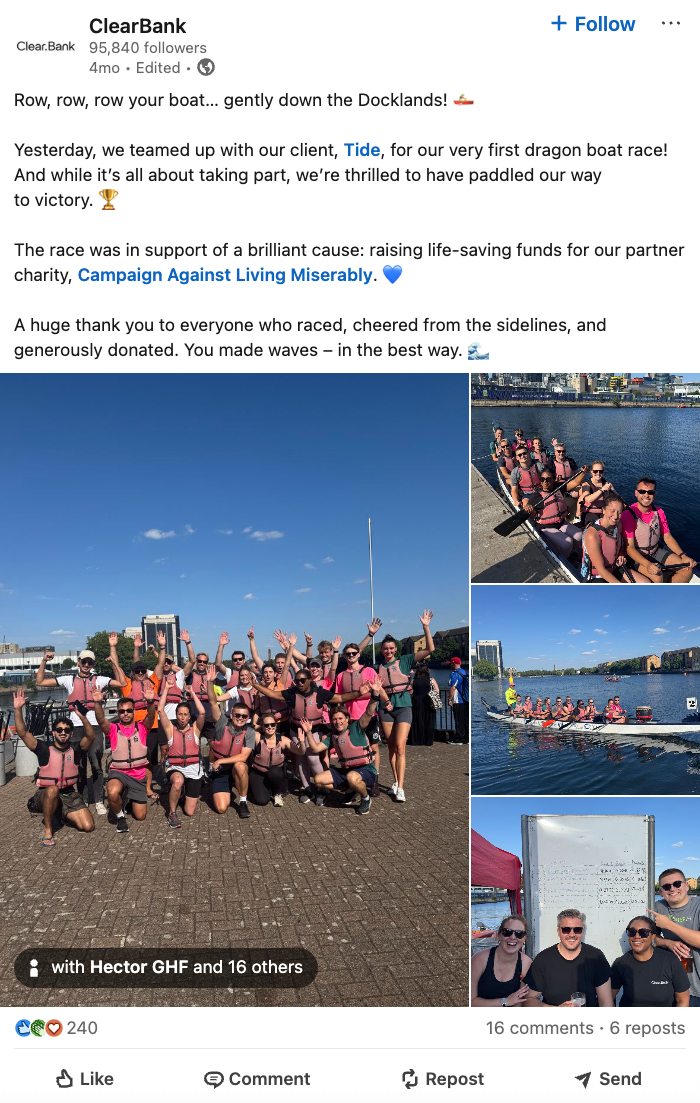

6. Behind-the-scenes looks

Showing the people and technology behind a brand humanizes fintech and builds credibility.

ClearBank’s post about its dragon boat charity race with its client Tide spotlights the people and culture powering the platform.

Source: LinkedIn

Putting a face to your teams builds connection and demonstrates transparency, which fosters trust with your audience.

7. Seasonal financial education series

Seasonal moments are natural prompts for money conversations. Holidays, summer breaks and back-to-school time all bring unique financial pressures.

Tide tapped into this by sharing carousel explainers with SME-friendly summer trading tips, showing businesses how to manage costs and keep sales strong.

Source: Instagram

Content like this positions fintech brands as timely, practical partners that understand real-world rhythms.

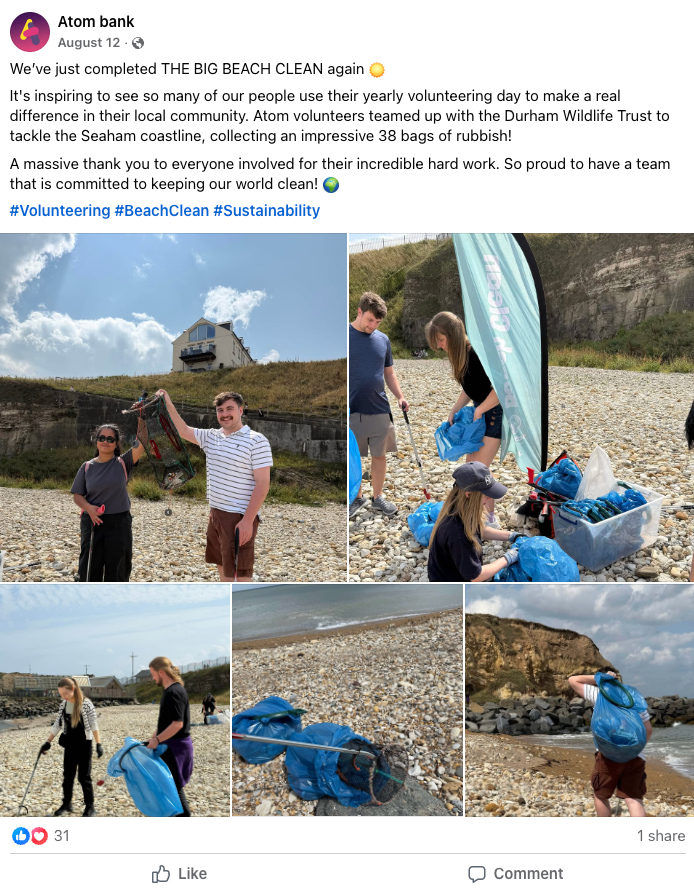

8. Cause-linked challenges or pledges

Cause-driven campaigns show customers what your brand stands for. When fintechs tie social content to movements like sustainability, financial well-being or community support, they connect with audiences on shared values.

Atom Bank’s beach clean campaign is a strong example of this. It spotlights staff in action while underscoring the company’s commitment to sustainability.

Source: Facebook

Inviting customers to participate in challenges like #30DaysNoDebt or #SaveForGood also builds community and shared purpose. Well-executed campaigns like these prove your fintech is about more than money, strengthening credibility and fostering long-term loyalty.

Turn compliance into your competitive edge on social

For UK fintechs, compliance doesn’t have to limit creativity.

By keeping content clear, accessible and audit-ready, your brand shows it takes trust as seriously as customers do.

With Sprout, you can balance engagement and compliance while building lasting trust by using tools like approval workflows, Smart Inbox moderation and Premium Analytics to streamline content creation and monitoring.

Ready to make social media your fintech brand’s trust engine? Start with a free trial of Sprout Social today.

Share