Social media for financial services: 7 tips to ace your marketing strategy

Table of Contents

Social media for financial services is a high-stakes channel and brands are right to approach it strategically. Compliance concerns, reputation risks and the challenge of creating genuinely engaging finance content make social adoption feel like a major hurdle.

But financial services brands aren’t a monolith. This complexity makes tailoring a successful strategy difficult but essential for capturing market share.

However, social media marketing isn’t just about trends and hashtags—it’s the definitive channel for building trust. In this guide, you’ll learn how to overcome these challenges, covering the full impact of social media on financial services, plus actionable tips and examples to help you build a winning, compliant strategy.

The influence of social media in financial services

Financial services marketing on social media transforms how banks, credit unions and investment firms connect with customers by building trust, providing education and delivering customer support across platforms like Instagram, LinkedIn and Facebook. Today’s financial institutions use social media to establish credibility, combat misinformation and create authentic relationships that drive business growth.

RFI Global’s latest research reveals just how much social media now shapes financial decision making:

- In the U.S., 44% of households rely on social media for financial insights, compared to 28% in 2022.

- In Australia, between 46% and 68% of borrowers say that social-media content has informed their understanding of banking products.

- Digital-only providers now serve 50% of adults in key markets in 2024 — up from 16% in 2018 — underlining how digitally-driven channels (including social) are central to financial services strategy.

This gap presents a major opportunity for financial services brands to step up as trusted advisors in the digital space.

Social media is also an excellent customer service platform. According to Sotrender, more than half of customers (54%) now prefer to reach out via social-media messaging channels rather than email or phone, highlighting why financial services brands can no longer treat social only as a marketing channel.

In fact, a recent J.D. Power study found that customers who engage with their financial providers through digital and social touch points report higher satisfaction and stronger loyalty, while costing less to serve—underscoring the business case for using social as a customer care channel.

Understanding your financial services audience on social media

Before you post, you need to know who you’re talking to. Financial services audiences aren’t a monolith. The social media habits of a recent graduate opening their first savings account are completely different from a seasoned investor managing a diverse portfolio.

Start by defining your key audience segments. Are you targeting first-time homebuyers, small business owners or high-net-worth individuals? Each group has unique pain points, goals and levels of financial literacy.

Understanding these differences is the key to creating content that resonates. It informs which platforms you prioritize, the tone you adopt and the topics you cover. This audience-first approach ensures your message not only reaches the right people but also builds the trust that’s essential in finance.

Top social media platforms for financial services

Depending on your target audience and overall marketing goals, some social media platforms may fit your brand better than others.

To help you see which one could be right for you (and figure out what to post), here are three social media platforms to consider focusing on.

Instagram is quickly becoming a go-to social media marketing channel for financial services. Due to its highly visual nature, it’s perfect for brands looking to showcase their personality and make finance more approachable.

For example, we love how Wells Fargo uses Instagram to highlight its company, culture and community initiatives, such as its Martin Luther King Jr Day of Service.

They also use easy-to-digest infographics to educate their audience on important financial topics, like this imposter scam carousel post.

As the largest and most popular social media platform, Facebook is still a powerful channel for digital marketers—especially if you’re interested in paid advertising.

Meta Ads allow brands to run highly-targeted campaigns across Facebook and other Meta-owned platforms. They also offer a wide variety of ad types, placements and delivery methods.

For example, SG, a French bank, used Meta’s Advantage+ placements to optimize ad delivery. Unlike regular Feed ads, Advantage+ automates ad placements across all Meta channels to maximize budget and reach.

And SG’s results speak for themselves. They experienced a 19% decrease in cost per acquisition with a 6% increase in reach compared to Feed placements alone.

LinkedIn is the world’s largest online professional network. Since it’s more business and employment-focused than other social media platforms, it’s a natural fit for financial services brands.

According to LinkedIn Marketing Solutions, members are 2 times more likely to seek out financial advice on the platform and 1.7 times more receptive to brand messages.

Accounting software company Xero uses LinkedIn Polls to engage its audience of small business owners. They also post humorous infographics, product announcements and informative carousel posts to entertain and educate their followers.

How to start a financial services social media strategy

Investing in social media marketing without a strategy is like setting out on a road trip without a map. You might get to your destination eventually, but you’ll probably waste a lot of time, energy and resources along the way.

Here’s a step-by-step process for building a financial services social media strategy from scratch.

- Conduct a social media audit. Take some time to review your accounts. What’s working (and what’s not)? What’s your audience engaging with? Is your branding consistent? A social media audit will help you establish some guidelines and identify key areas for improvement.

- Establish clear social media policies and guidelines. Define clear rules, processes and approval workflows for content creation, engagement, compliance and security. Ensure all social team members can easily access these policies by integrating them into your workflows and platforms.

- Use a consistent and trustworthy brand voice. What are your brand’s core values? How do you want our audience to feel when they interact with you? Use these questions as a jumping-off point to develop clear tone and messaging guidelines. Similar to your overarching social media policies, these guidelines should be easily accessible. Team members should also review all posts to ensure consistency.

- Use tools for social media management and analytics. Social media management platforms like Sprout Social help streamline and automate many essential social media tasks. Use them to schedule posts, track engagement, monitor brand mentions, analyze performance data and more.

- Monitor and respond to customer inquiries promptly. Social media never sleeps, so use management tools to track comments and messages. Set up real-time alerts to stay on top of conversations. Reply templates and response workflows also help speed up the process.

- Build brand trust by building an employer brand. Use social media to highlight company culture, values and employee experiences. For example, we love how CIBC features co-op student profiles on their Instagram page to promote career opportunities. Also, consider empowering employees to be brand advocates. With our Employee Advocacy platform, brands can compile social content into newsletters or broadcasts to share on internal platforms like Microsoft Teams or Slack.

Interested in learning more?

Learn how Monzo Bank stands out for their exceptional social presence, not just for financial brands, but all brands. How did one financial institution become a leading brand on social?

8 tips to ace social media marketing for financial services

Now that you understand the top social platforms and how to build a social media strategy from the ground up, let’s go over how to make the most of your social media marketing efforts.

Here are some helpful tips to get you started.

1. Ensure you meet regulatory and compliance guidelines

Financial services marketing must comply with multiple regulatory bodies that protect consumers and promote transparent practices.

Essential compliance steps include:

- Understand requirements: Research FTC, CFPB, SEC, FINRA and other relevant regulations for your institution type

- Establish processes: Create approval workflows that ensure all content meets regulatory standards

- Legal review: Have your legal team approve content before publication

To help your team stay organized while navigating these rules, download our social media compliance checklist for financial institutions.

2. Create authentic, targeted content

Social media is great for injecting personality into a more buttoned-up brand. But trying too hard to be relatable and fun can also backfire and become cringeworthy. For example, our 2025 Sprout Social Index found that most consumers don’t want brands to jump on viral trends for content.

The best approach? Focus on creating digestible content that’s still informative, valuable and on-brand. For example, privacy and data security concerns are at the top of many consumers’ minds, so consider creating content that helps your customers protect themselves—like this post from TD Bank.

3. Use influencers to broaden your reach and trust

Partnering with a financial influencer can help bridge the gap between your company and your target audience. Influencers know how to make scroll-stopping content and have engaged, loyal communities that you can tap into. Plus, they add the unmistakable human touch to your content that social audiences crave.

For example, Vivian Tu (aka @your.richbff) has grown a community of over 5 million followers across Instagram and TikTok and they love her down-to-earth finance tips. She’s one of the top voices on #FinTok and she’s also partnered with financial services brands like fintech company SoFi.

Of course, finding aligned ‘finfluencers’ is easier said than done, so consider using a tool like Sprout Social Influencer Marketing to make the process more efficient. The all-in-one influencer management platform includes powerful discovery features, like hyper-targeted search filters and an Affinity Engine that identifies right-fit influencers automatically.

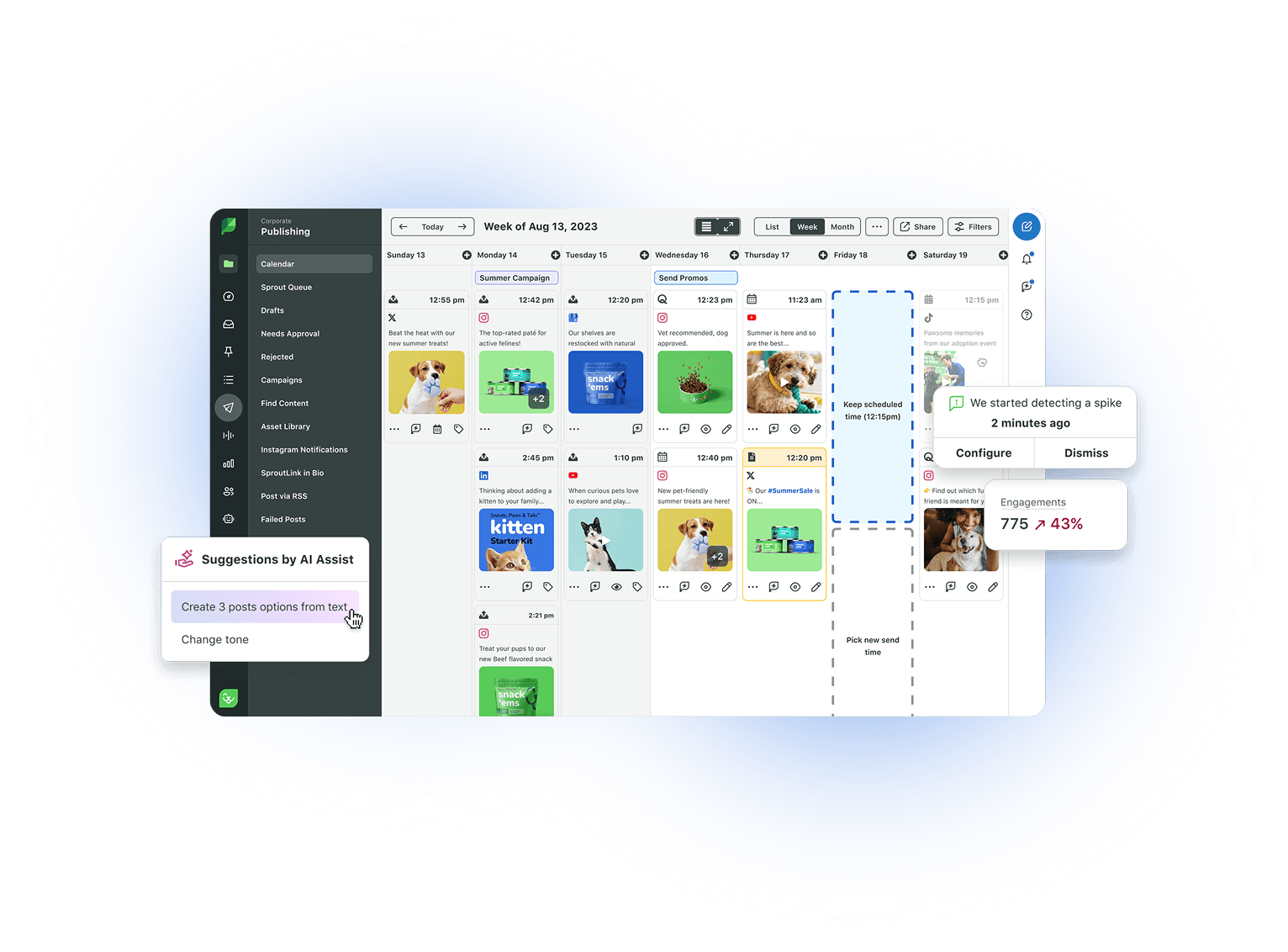

4. Use social media management tools to streamline workflows

Managing multiple social accounts becomes overwhelming without the right tools. Social media management platforms streamline workflows by centralizing scheduling, content curation and analytics tracking in one unified dashboard.

Sprout Social streamlines financial services social media management with integrated features:

- Smart Inbox: Centralized message management across all platforms

- Collision Detection: Prevents duplicate responses from team members

- Publishing Tools: Schedule content across multiple platforms with consistent branding

- Asset Library: Store compliance-approved visuals and templated responses

5. Level up customer care with AI and automation

If you use social media as a customer care channel, adding AI and automation to your workflow will help you work smarter, not harder. For example, Sprout Social has Enhance by AI Assist, which uses generative AI technology to help marketers edit the length and tone of their replies.

Message Spike Alerts allow users to set up notifications for when a social account experiences a rapid increase in incoming messages. This way, marketers can quickly respond to any potential crisis communications issues without needing to be ‘always on’ or check social platforms outside of work hours.

6. Prepare for crisis management and reputation protection

In financial services, your reputation is your most valuable asset. A single misstep on social media escalates quickly, so having a proactive crisis management plan isn’t just smart; it’s essential.

Establish a clear protocol for responding to negative feedback, misinformation and potential compliance breaches. This includes defining roles, setting up approval workflows and having pre-approved messaging ready to deploy.

Use tools with features like real-time spike alerts to monitor for unusual increases in message volume. Getting ahead of a story gives your team the power to manage the narrative, protect your brand and maintain customer trust when it matters most.

7. Use social listening to improve customer experience

Creating and posting content is just one aspect of social media marketing. If you want to stay ahead of the curve—and get a stronger sense of what people think and feel about your brand—you should prioritize social listening.

Track and analyze brand mentions and competitor activity in real time with Sprout Social. Our data-backed insights will help you measure brand health and sentiment, identify industry trends as they emerge and see how your brand stacks up against competitors.

For example, Reddit is one of Sprout Social’s most valuable social listening sources. Because Reddit allows anonymity, it’s a goldmine for honest, unfiltered audience opinions.

Plus, Reddit’s partnership with Intercontinental Exchange makes it easier for financial professionals to access valuable data that can inform investment decisions and improve risk management strategies.

8. Gain insights from social data

What does social media success look like for your brand? More followers? Engagement? Conversions? Once you establish your goals and KPIs, track and report on your metrics to measure your progress.

With Sprout Social, marketers can access comprehensive social media analytics, including post engagement, audience demographics, growth trends and competitive data. The platform also generates a variety of reports and data visualizations, making it easy to extract key insights and optimize your strategy moving forward.

To test out these features for yourself, start a 30-day trial today.

Examples of social media for financial services

Need more inspiration? Here are three financial services brands creating exceptional social media content, plus key takeaways to help you define your approach.

1. Bank of America

Bank of America posts a wide variety of content on its Instagram account, from carousels on budgeting tips to statistic infographics. However, where they really shine is how they highlight their brand partnerships.

To promote its partnership with the FIFA World Cup, the bank has three pinned posts on its Feed and updated its profile bio.

2. Barclays

Barclays, a global financial services company based in the UK, uses Instagram to both inform and entertain its audience with a mix of street interviews, influencer content and animated videos.

For example, this short video post teaches their audience how to spot scam red flags. It breaks things down in an easy-to-understand, engaging and professional way without oversimplifying.

3. Coinbase

Coinbase, a digital currency exchange that allows users to buy, sell, store and transfer cryptocurrencies, has more creative and tongue-in-cheek content than we typically see from a financial services brand.

They transform weekly exchange performance charts into visually engaging carousels. They also collaborate with digital creators to produce explainer videos that break down complex financial topics in a unique cinematic style.

4. Rocket Companies

Rocket Companies, a fintech platform with mortgage, real estate and personal finance businesses, launched a groundbreaking marketing campaign for Super Bowl LIX.

The campaign featured a 60-second ad set to a cover of “Take Me Home, Country Roads.” It then extended into a live stadium singalong, creating a first-of-its-kind Super Bowl moment.

After the game, the brand repurposed the ad content into a YouTube video series. The series included an interview with the chief marketing officer discussing the campaign’s inspiration, footage of the stadium singalong and both shortened and full-length versions of the ad.

How to strike the right balance with social media in financial services

It can be tough to strike the right balance with social media for financial services. Your brand needs to be accessible and engaging, but also credible and compliant. And in such a highly regulated industry, creating content that stands out—without breaking any rules—can feel like walking a tightrope.

What we recommend? Get support. Social media for financial services isn’t a one-person job. Marketers, compliance teams and industry experts must work together to create accurate, engaging and on-brand content.

You also need enough time, resources and an approval process to plan and create brand-safe content. If you’re starting, focusing on more evergreen content—like financial tips, FAQs and expert insights—that can be approved and scheduled in advance is more sustainable than chasing viral trends.

Want even more insights on what consumers actually want from brands on social? Check out our 2026 Social Content Strategy Report to learn more about what you should prioritize and what content and platforms will get you the best ROI.

Social media for financial services FAQs

How do I measure social media ROI for financial services?

Track conversions using UTM parameters to measure how social drives loan applications, account sign-ups and consultation requests. Connect social data to your CRM to follow the complete customer journey from first touch to final conversion.

What are the most important compliance considerations for social media?

Financial institutions must archive all social communications per FINRA and SEC regulations, include clear disclosures on promotional content and protect customer data privacy. Avoid soliciting testimonials, which is prohibited in many financial sectors.

How should financial institutions handle negative feedback on social media?

Acknowledge concerns publicly, then move conversations to private channels like DMs or phone calls for resolution. Never share personal account information publicly and use feedback to demonstrate customer service commitment.

Which social media platforms should financial services prioritize?

LinkedIn excels for B2B marketing and wealth management, while Facebook and Instagram work best for consumer banking and community building. Choose platforms based on your target audience demographics and marketing objectives.

How do I balance compliance with engaging content creation?

Focus on educational, evergreen content that answers audience questions rather than chasing trends. Establish streamlined approval workflows with your compliance team to ensure content is both engaging and fully compliant.

Share