How to build a social media scorecard that closes the reporting gap and proves ROI to leaders

Table of Contents

Executive leaders often rely on metrics like stock price, profit margins and revenue growth to monitor the health of their business, and for good reason. But if they aren’t factoring in meaningful social media data, they risk missing crucial insights. This is especially true in business today, where, according to The 2025 Impact of Social Media Marketing Report, 56% of marketing leaders say social media now drives revenue for their companies.

When social practitioners communicate the importance of social data to leadership, those leaders can then take action on what that data represents. And with the massive amount of social media data available today, executive leaders are eager to tap into it.

Companies have already adapted to these changes at a global level; according to the same Impact of Social Media Report, 83% of leaders rate their team’s content strategy, driven by social, as expert level—with strategies rooted in audience insights, aligned to business objectives and used to inform content on channels beyond social. The report also found that overall, 80% of marketing leaders plan to reallocate funds from other channels to social, indicating social now has increased financial backing after demonstrating proven results.

This revaluation of social is welcome, but practitioners need to continue showcasing social ROI to executives to secure the necessary financial backing. Executive leaders need to see contextualized social media metrics like sentiment analysis, customer satisfaction and competitor benchmarks to make informed decisions. And one of the key ways you can communicate these metrics is through a detailed social media scorecard. Below, we’ll explain what this is, and what your next version should include.

Why a social media scorecard is crucial for leadership

Most CEOs are already a part of their brand’s external social strategy. But there’s been an important shift in how social media metrics are perceived, and in how success on social is measured. Today’s social leaders are moving away from vanity metrics and toward value metrics. This shift aligns to what execs want to understand about social media: how does it drive the business forward?

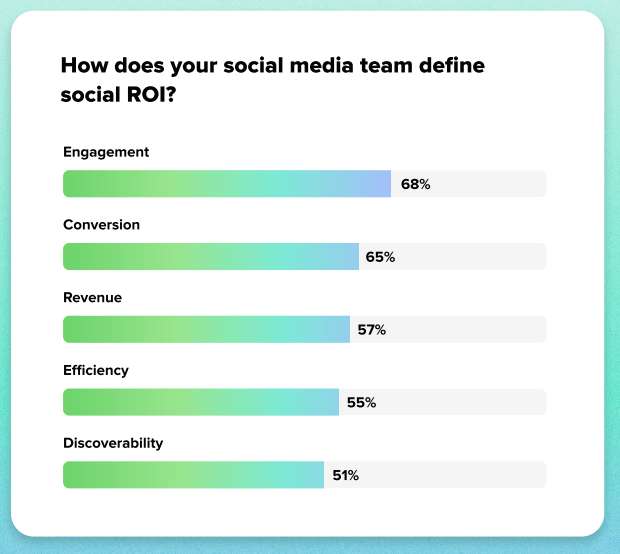

For example, according to the 2025 Impact of Social Media Marketing report, social media teams now define social ROI through engagement (68%), conversion (65%) and revenue (57%) above all other metrics. Both conversion and revenue communicate value to leaders instead of vanity. And when you examine engagement through a deeper lens, such as audience sentiment and contextualized performance data, you deliver social intelligence that execs can act on. Sharing this information regularly through a dedicated social media scorecard gives leadership a steady stream of insight.

Social media scorecards also support several key companywide benefits, including:

Understand audience insights

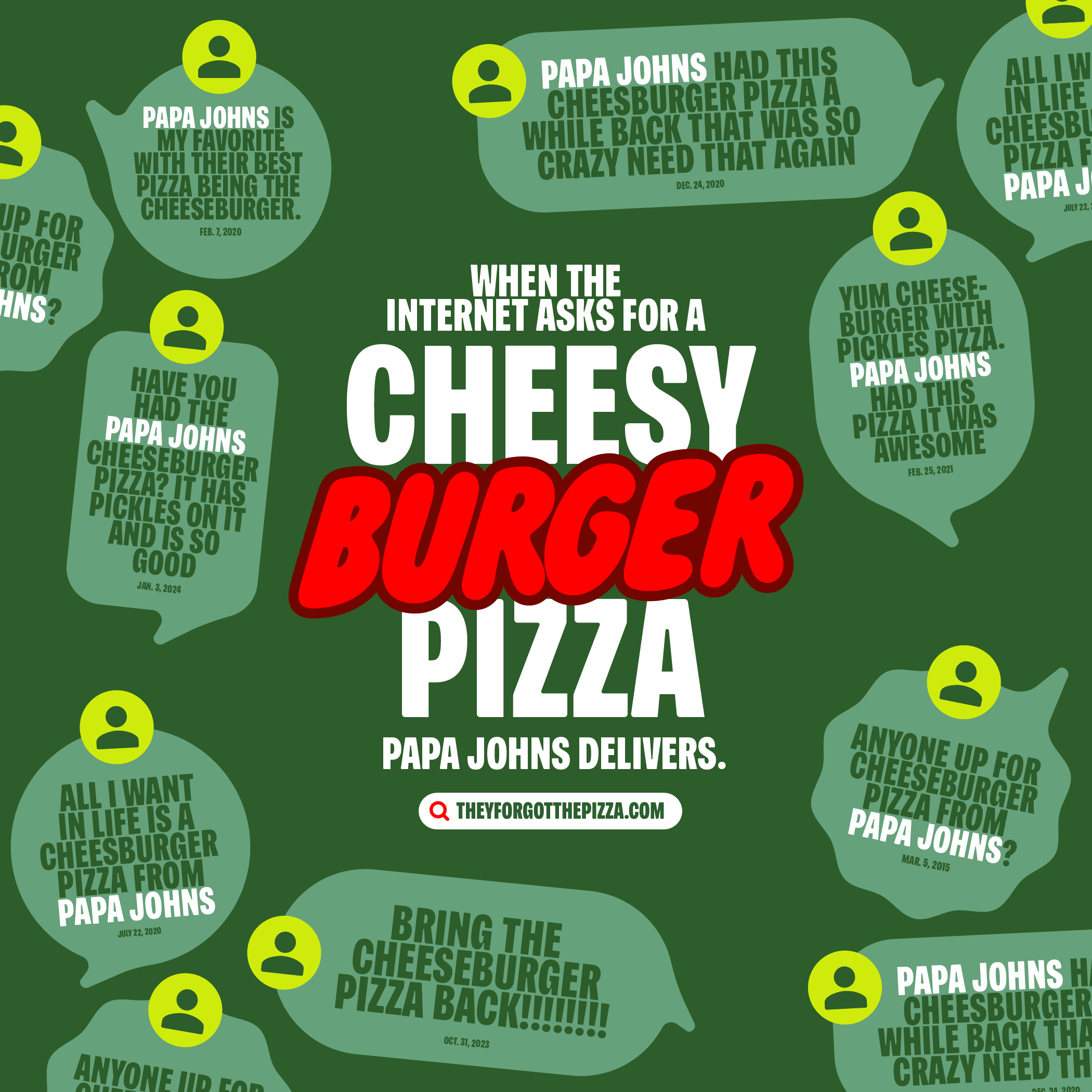

Insights from social go far beyond likes, comments and engagements. Social is a 24/7 focus group where you can find unfiltered feedback about how your brand and products are perceived. AI-powered tools like social listening enable you to analyze these customer conversations at scale, uncovering emerging trends in time to change or capitalize on them.

Effectively analyzing your audience sentiment can uncover insights that wouldn’t be possible through other methods. Using these insights, assess how your brand is perceived, what common problems your customers are facing, and which new features or tools they’re asking for.

Identify opportunities for growth

Customer voices and insights from socials equip companies with the feedback needed to grow in the right direction—from developing new products to charting expansions to building brand partnerships. With social insights, you can discover consumer pain points, where your target audience is located and how they use social and other brands they love. These learnings help your team create more effective campaigns, focus product development efforts, and drive sales.

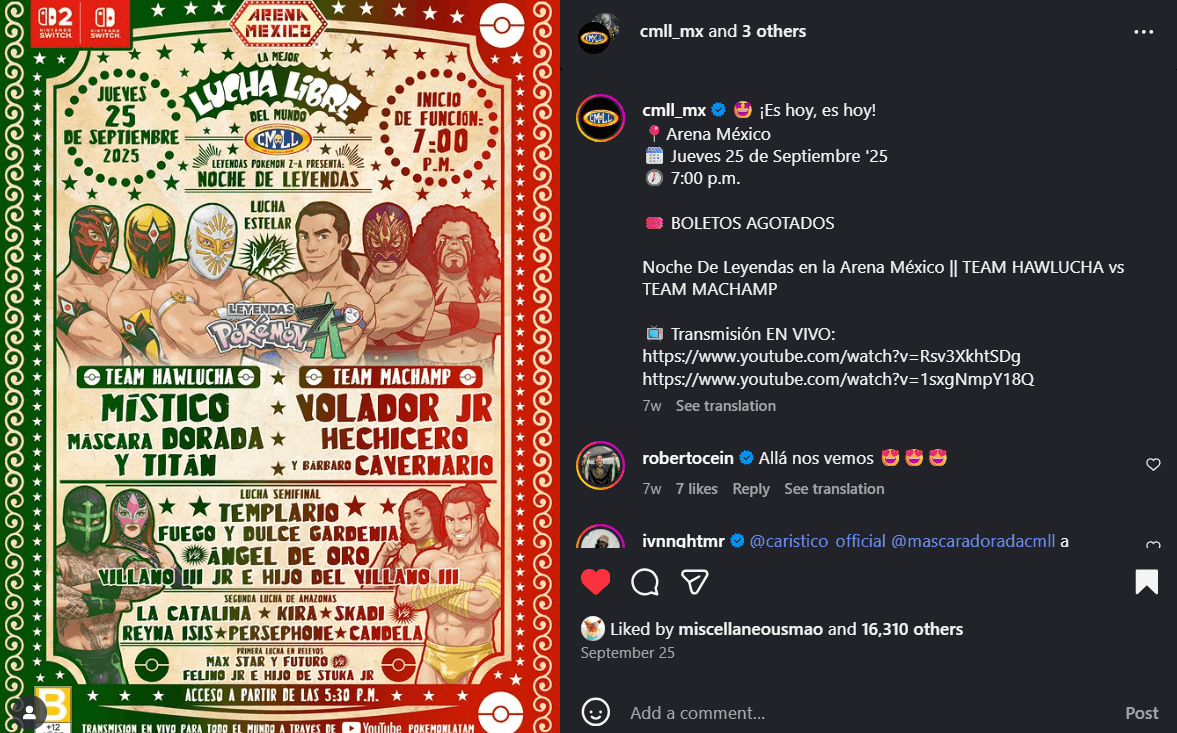

A recent example is the regional collaboration between The Pokémon Company and CMLL in Mexico. To boost LATAM awareness and sales for their new game, Pokémon hosted a branded lucha libre event with CMLL. The event was promoted heavily on all socials, including a YouTube livestream, and resulted in a sell-out show and growth in the awareness of the new video game.

Improve customer experience

According to The 2025 Sprout Social Index™, 73% of consumers say when a brand doesn’t respond on social, they will buy from a competitor next time. By regularly reviewing customer care metrics like response time and customer satisfaction, leaders can make sure teams have adequate resources, training and headcount to exceed customer expectations, especially during the busiest seasons. Many global companies are already leveraging social media management tools to vastly improve their customer care potential.

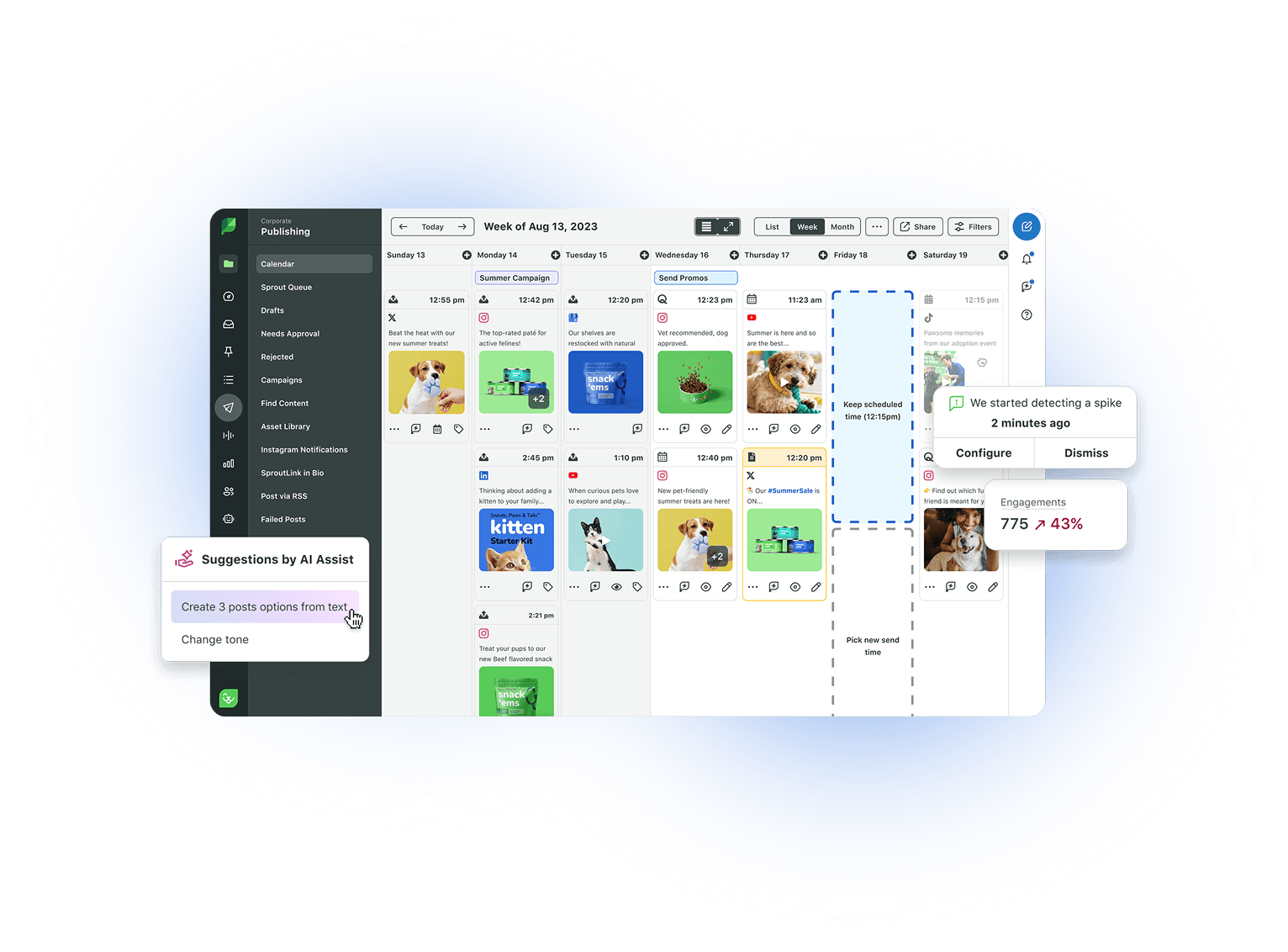

By using Sprout Social’s Smart Inbox feature, Papa Johns saw a 50% improvement in their overall response rate.

Josh Martin, Director of Social Media and Brand Management at Papa Johns, said: “As a result of the Smart Inbox feature, response time has been cut in half since switching over to Sprout, as the team is able to move through the inbox much faster than before. The team is managing 600+ cases a week and saving 2 days worth of work each week—over 830 hours a year.”

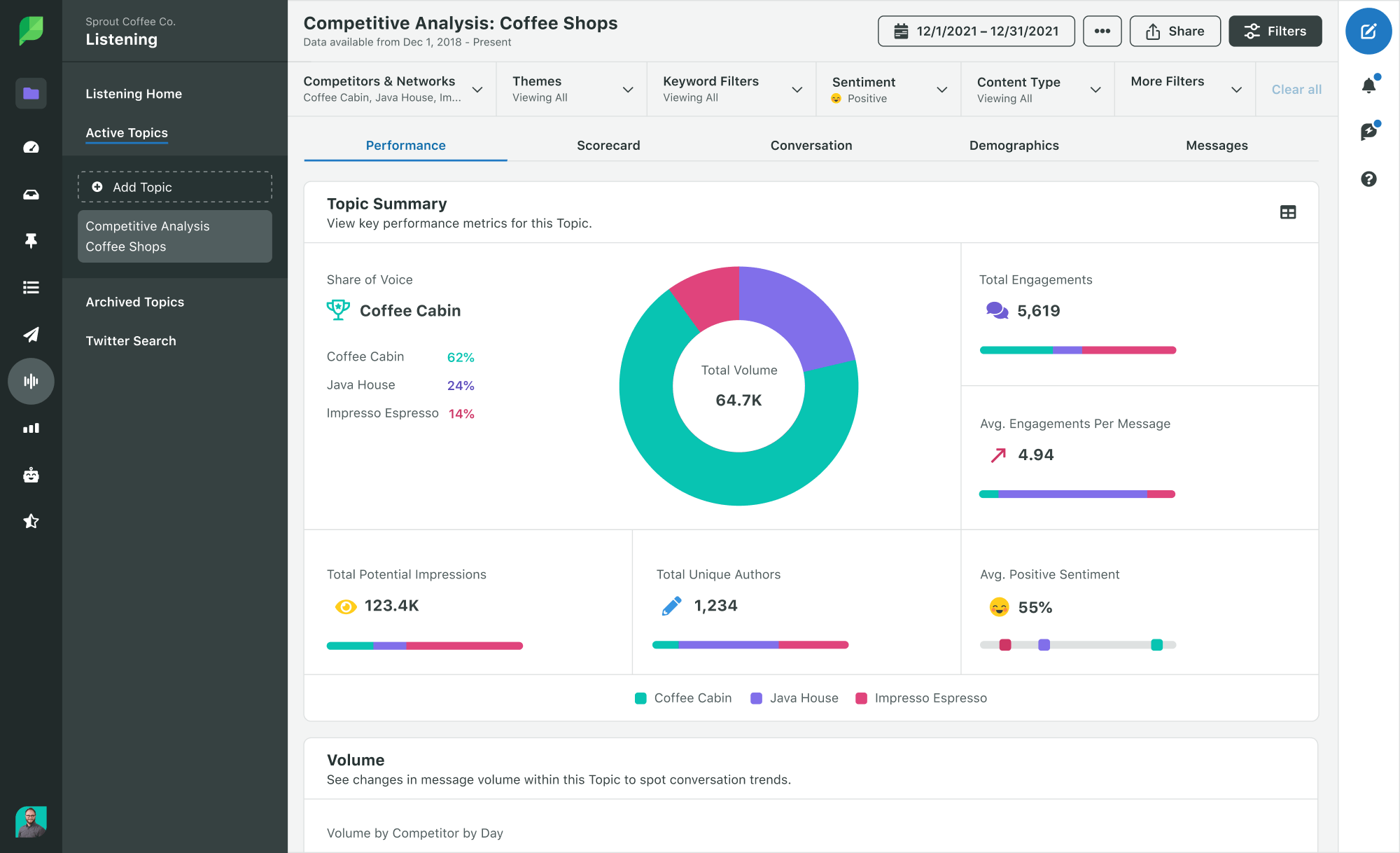

Track competitor performance

Today, new competition emerges faster than ever, brands are up against legacy companies and D2C players alike, and you must compete for attention with companies far beyond your industry. So how can you make sense of it all?

Weaving together your brand’s performance metrics with competitor data and industry benchmarks creates a more complete picture of social’s impact, and adds much-needed context that will make social data meaningful across your org. Knowing the details of your competitors’ performance helps gauge the value of your own, set smarter goals and refine your PR, sales and product development strategies.

With a tool like Sprout Social, you can visualize how your share of voice, engagement, sentiment and impressions data stack up to your competition, helping your brand stay on the pulse of what messages and strategies are resonating in your industry.

Experience how automated competitive insights can transform your social strategy with a risk-free trial.

Key considerations for executive reporting

Executive reporting comprises a number of different business areas, and the same holds true when reporting based on social data. These are some of the key ways you can use the data gained from your social profiles to create detailed, impactful reports for leadership teams.

Focus on social intelligence

The data you collect on social media should translate into social media intelligence when preparing your social media scorecards. This is the process of analyzing the data you’ve collected with wider business decision-making in mind.

Proactively collect data to gain actionable insights on all facets of your social marketing, including topics you might not have considered. Look at techniques like media monitoring that allow you to gather further insights about your competition and your wider market. Conduct A/B tests to gather more data about what content resonates (and why), and then use social listening and other strategies to get a bigger picture of what your customers think about your brand.

Remember that your social data is only as powerful as the way it’s presented. Gathering insights is the first half of the battle, but turning those insights into intelligence allows them to impact and influence your executive leaders. Think about how you can present your insights in a way your modern leaders will understand.

Showcase the cross-functional potential of social insights

Marketers and social practitioners often forget not everyone works in marketing. This means not everyone understands the same jargon as you, or shares the same metrics or touchpoints. Use your scorecard to tap into the cross-functional possibilities of your data, so you can use the information to benefit your entire company.

For example, if you’ve collected data surrounding a new feature or product launch, segment those conversations into insights that relate to financials, performance or general customer satisfaction. You’ll then be able to deliver these insights in relation to each department, covering what’s going well and what needs to change for each team.

Showcase a range of different metrics in your scorecards, and note how each of them impacts different departments. If you’ve tracked conversions, look at the estimated revenue gain to present to your finance team. If you’ve tracked review sentiment, deliver these to your product department so they know what users are thinking. Tracking ROI on campaigns is also a useful way of creating a wider metric that’s useful for your entire business, particularly if you’ve managed an influencer campaign.

The more you embrace the cross-functional possibilities of your social intelligence, the more your scorecard is likely to resonate with and inspire your executive leadership.

Reframe metrics and context to highlight business impact

As mentioned above, Sprout’s 2025 Impact of Social Media Marketing report found that the following metrics are most common when defining social ROI:

- Engagement – 68%

- Conversion – 65%

- Revenue – 57%

- Efficiency – 55%

- Discoverability – 51%

Your scorecards should include a combination of these metrics when delivering your data to executive leaders. But it’s also vital that you reframe each of them to prove where each impacts different parts of your company.

As an example, revenue can show the financial benefits of your social media output. As a social practitioner, present this data to your marketing department when considering your annual marketing budget. Or, present to adjacent teams like events or comms to determine their budgets. Meanwhile, present the efficiency of your social content from an operational perspective to managers, so they can consider how to optimize other parts of the business.

No single social media metric exists in a vacuum; they each impact your company in several ways. The role of your scorecard should be to reveal these impacts in a clear, easily digestible way, with considerations for how to use this data to make positive changes for the future.

What to include in your social media scorecard to capture executive attention

When creating a social media scorecard, it’s most important to include metrics important to your specific business and industry. If you need help getting started, here are a few elements to consider. Choose which ones are best based on your team’s social media tactics:

- Executive summary: Include this at the start of your scorecard to capture a general picture of your social performance, and to introduce some of the more detailed metrics shown later.

- Average engagement rate: Your engagement rate is a strong indication of how well your social content is performing overall.

- Organic social + influencer impressions: This data explains the overall impact of your organic social output and offers a comparison against influencer campaigns to prove their benefits.

- Conversions + leads and cost per lead: This data will identify how well your social content is converting, as well as how much it’s costing you to create leads.

- Customer care metrics like total received messages, actioned messages and action rate: This data can identify how effectively you’re managing your social inbox.

- Competitive scorecard: Create one of these that tracks audience size, sentiments and potential impressions across you and your competition, to determine your relative size and impact across your industry.

- Top performing posts: These insights can inform your content strategy and your overall marketing plan.

- ROI on tool use: Collect the time saved and other metrics for tool use to determine their value to your team.

- Brand health/audience sentiment: Consumer perception of your products, services or brands. Typically, this data is reported as positive, negative or neutral.

- Earned media value: The financial amount that you would need to spend to achieve the same level of promotion that your organic efforts are achieving. In other words, how much your company is saving by posting organic social content.

- Key social listening findings: While this will vary based on your company’s goals, this data should indicate the volume and sentiment of keywords surrounding your brand and products. For example, these metrics could speak to the success of your latest campaign, a new launch or relevant industry news.

- Key insights and further actions: Include this section at the end of your scorecard to identify the main points raised and how you can take action.

The future belongs to brands that put social first

Social-first brands are leading the charge across their industries when it comes to innovation, social impact and brand presence. More executive leaders than ever before are starting to identify the connection between success on social media and overall business success.

Creating a social media scorecard is your opportunity to build the necessary reporting infrastructure needed to speak to these leaders in their language. These scorecards can earn executive trust by transforming social data into strategic action for the entire company.

If you’ve never created a scorecard before, or you need clearer direction with your next version, download Sprout’s free social media scorecard template today.

Share