The dynamic duo fueling organizational growth

In the early days of my career, the finance team was considered a back office function.

When other departments came to my office, it was usually to ask questions about resource allocation, not for insight on how to do their jobs better. Trust me; no one in marketing was coming to me for creative advice (I wouldn’t have given it anyway). Likewise, I never thought to go to marketing for input on a cost benefit analysis project.

But as companies grow increasingly digital and data-driven, keeping departments in silos is no longer the norm. I’ve seen firsthand how my role as a CFO has transformed from accountant to supporting partner to strategic advisor. CEOs aren’t coming to CFOs just to ask questions about risk management and budget; they’re also looking to the finance team for insight on data-driven strategy and the best way to utilize resources. When you ask CFOs where they feel they provide the most value, 40% will say they contribute in the form of strategic leadership and performance management functions. And 81% of finance leaders say one of their main responsibilities involves identifying new areas of growth across the business.

As CFOs embrace a more proactive advisory role to other departments, organizations gain an unbiased and objective perspective focused on making decisions for the collective good. The team up between CFOs and the head of HR, for example, can result in valuable new hires who fulfill a specific need in a company’s big picture objectives. But if it’s competitive agility and rapid growth organizations are after, it’ll take a collaboration between the CFO and CMO to bring those results to life.

A tense beginning

Historically, the only times CFOs and CMOs crossed paths were to talk about budget allocation. And by far, these weren’t the most pleasant conversations to have.

When marketing needed additional resources, they would make their case to the finance team who then decided whether or not to approve the request. But for the money-conscious CFO, and especially for those who are dead set on tracking every single dollar, not knowing where or how that money is spent often stalled budget talks. A Deloitte study found 94% of CFOs said they would direct more funding to digital marketing efforts—if CMOs could show a direct correlation between digital campaigns and sales. On top of that, CFOs often treated marketing as little more than a cost center.

Another challenge? The metrics CFOs and CMOs use to track their progress differ, too. Historically, marketers turned to qualitative measures to demonstrate the impact of campaigns while the finance team used quantitative metrics to evaluate success. While CMOs talk about factors like impressions, awareness and share of voice, CFOs want to know what the net profit margins, payback metrics, efficiency and operating cash flow look like. Add to this an overall lack of transparency and conflicting expectations around ROI, it’s no wonder CFOs and CMOs have stayed in their respective lanes.

The new C-suite power couple

What makes the CFO and CMO relationship so valuable is it unites the team responsible for value creation with the team that scrutinizes every investment to get the most bang for their buck. For marketers, the ability to quantify their efforts sets CMOs up to make a strong business case for the resources they need. And for CFOs, having a better understanding of where marketing dollars are spent ensures money is invested in projects proven to drive results.

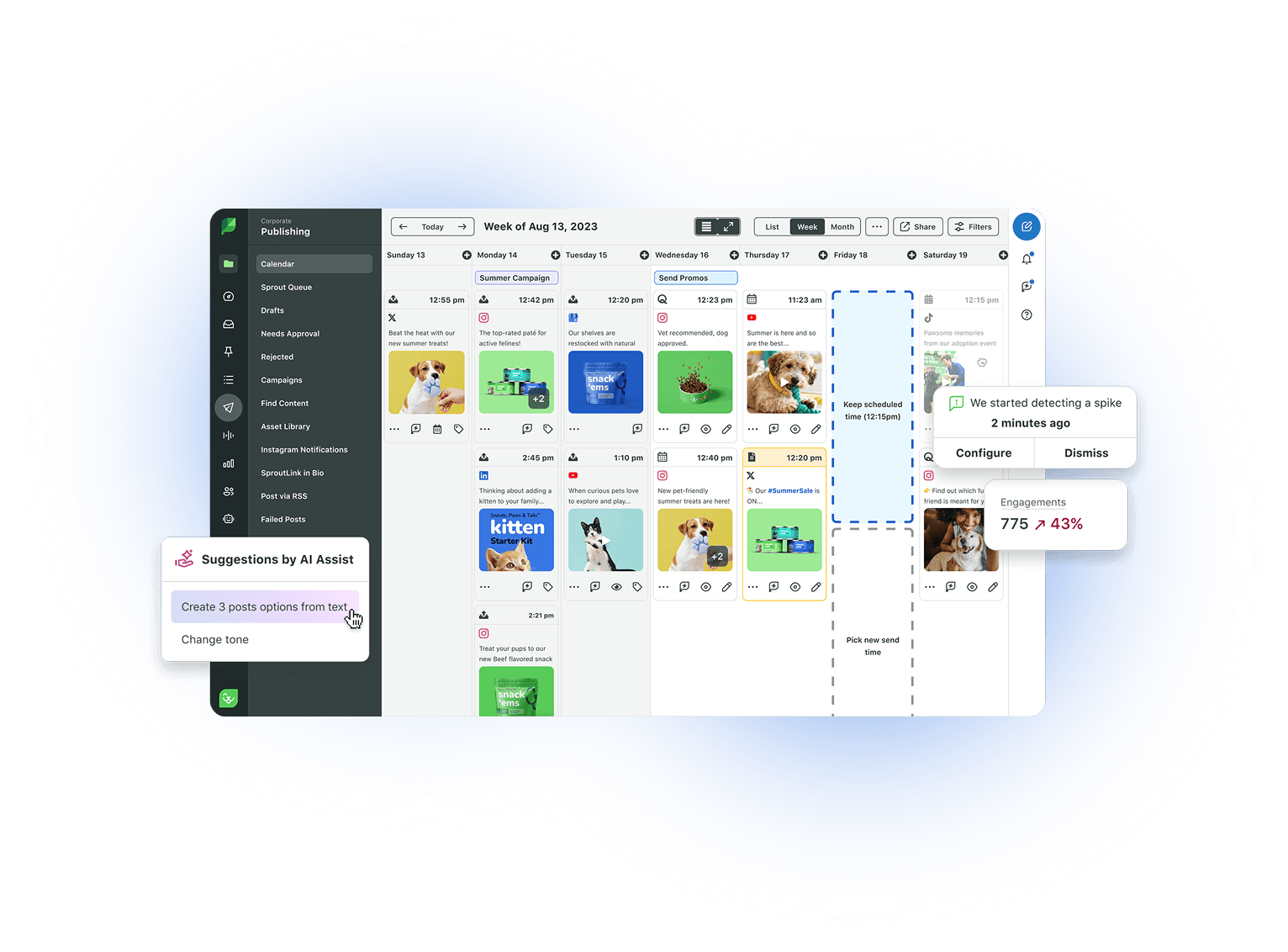

Like their finance counterparts, marketing leaders are tasked with a new set of expectations like demonstrating their return on investment and uncovering new growth opportunities. Eighty-three percent of CEOs believe marketing is a major driver of growth and this is especially true in today’s consumer-driven environment. As the team that largely owns the customer experience from start to finish, marketing plays a big role in maximizing customer value through all points of the journey. At Sprout Social, for example, a significant portion of our business is driven by inbound marketing efforts, proving marketing fulfills more than an awareness and perception function. Our marketing team works on initiatives responsible for driving sales, extending the value of current customers and pivoting to always stay ahead of competitors.

As a CFO, it’s my job to evaluate the different investments each department makes and identify which activities are the most aligned to our business’ goals. If the marketing team is doing something that generates revenue, I want to know what the return on investment is and if that’s something we need to allocate more budget to. Likewise, if a campaign isn’t worth the risk, it’s on finance leaders to advise the CMO on when to change course. CFOs can also offer forecasting and efficiency metrics to CMOs who need to assess new revenue streams of future campaigns.

Paving the way to a valuable partnership

As companies become increasingly more data-driven, expect to see the CFO-CMO alliance become a staple in organizations. Unlocking the potential of a finance and marketing collaboration, however, calls for a realignment of goals and getting both teams on the same page.

In my experience working with marketing teams over the years, here are three things I’ve learned that help CFOs and CMOs become each other’s greatest allies:

- Education is the greatest equalizer. One of the first things I did after joining Sprout as was to sit down with several marketing executives to learn about what goes into the development and assessment of campaigns and initiatives. While it didn’t transform me into a marketing expert overnight, it did provide me with an understanding of how marketing sets goals and objectives. Likewise, don’t just assume CMOs know how you come to important financial decisions. Taking the time now to outline the specifics of each team’s roles and responsibilities can help both executives avoid misconceptions and confusion down the road.

- Figure out what success means to both teams. How CFOs and CMOs determine success will differ from one another. It’s like comparing apples to oranges—if I’m trying to reduce the cost of a certain initiative, how does that translate into a marketing “win”? Likewise, if a CMO’s goal is to increase top of funnel leads in six months, how does that tie into a CFO’s forecast? For a marketing and finance team up to be effective, both parties need to agree on what a win looks like before launching any joint collaborations.

- Mutual trust is non-negotiable. A successful CFO-CMO collaboration also hinges on trust. Sometimes all parts of a marketing campaign won’t be measurable… and finance executives need to learn to live with that. As CFOs, we have to be willing to take risks on initiatives that we’re not totally certain will work and trust our CMO partners know what they’re doing. There needs to be mutual respect between executives in case an expensive initiative isn’t producing results and needs to be shut down immediately. The more we can trust one another, the more productive and agile the CFO-CMO collaboration will be.

The CFO is fast becoming the CMOs greatest ally—and vice versa. In breaking down the silos previously keeping finance and marketing apart, businesses stand to benefit from a partnership that fuels innovation and competitive agility. While it’s not the most intuitive relationship, companies would be wise to start cultivating their own CFO and CMO alliance today—or risk leaving new opportunities for growth on the table.

Share