Facebook Marketing

Facebook marketing: The complete guide for your brand’s strategy

Explore our comprehensive guide on maximizing your Facebook marketing strategy. Leverage our robust advice to enhance brand visibility, engagement, and ROI on Facebook.

Reading time 17 minutes

Published on December 14, 2023

Table of Contents

Summary

- Facebook remains a crucial platform for brand presence with over 3 billion monthly active users, especially favored by those between the ages of 25-34.

- Facebook marketing involves promoting a business via a Facebook business Page and utilizing its ad platform for organic and paid promotions across various post types (photos, videos, carousels, etc).

- Benefits of Facebook marketing include improving conversion rate by an average of 9.21%, incorporating ecommerce directly on the platform, and utilizing Facebook analytics for precise audience targeting.

Social media platforms may rise and fall but Facebook remains a vital staging ground for building a strong brand presence. With over 3 billion monthly active users, Facebook is the favorite social platform of users aged 25-34 who also have a high average disposable income.

Our 2023 Q4 Pulse Survey data also revealed that Facebook remains the top platform where most consumers intend to post and share content, followed by Instagram and TikTok. This makes Facebook marketing one of the most compelling ways to enhance your brand identity and share of voice.

Our in-depth guide will help you use Facebook to its full potential and navigate the platform with the tools available. Watch the video below to hear why you shouldn’t sleep on incorporating Facebook into your social media marketing strategy:

What is Facebook marketing?

Facebook marketing is the act of promoting a business or brand and its products/services via a Facebook business Page. By fully optimizing these business Pages, brands create a second website of sorts, where you can advertise and sell products and services directly to your target audience. Facebook’s ad platform enables you to go beyond organic promotion, creating paid posts in various post types (i.e., photos, carousels, videos, links) to maximize engagement.

Thus, with a well-planned strategy, you can use Facebook to support the full customer experience from awareness to purchase and loyalty.

Why you should use Facebook marketing

There are several reasons to include Facebook in your social media marketing strategy. This includes enhancing brand awareness, increasing customer engagement and reaching new audiences. Facebook has the potential for significant brand amplification and return on your investment with over 65% of U.S. social commerce buyers using it regularly.

Not convinced? Here is a breakdown of our top five picks for why Facebook marketing must be on your radar when planning your marketing strategy.

Improve your brand’s visibility

While 71% of Facebook users are primarily on the site to keep up with friends and family, a sizable number visit it for customer service, entertainment and to follow brands. This means you can present your brand to visitors whose motivations range from idle curiosity to active engagement, which includes purchases. The average conversion rate on Facebook for sales is 9.21% across industries.

Create more engaging content

Facebook supports content in four formats: images, video, carousel and collections. This gives you four ways to use captivating visuals to engage prospective customers.

If you’re running a retail store, a carousel or collection enables you to display a selection of top-selling items or unveil a new product line. Perhaps you have a B2B (business-to-business) service to promote? A video about your services or customers might sell your offering more effectively. Sometimes a single striking image can drive traffic to your site.

Facebook offers all these options to easily create campaigns for different purposes.

Appeal to your target audience

Facebook analytics provides a wealth of data about your performance and audience preferences. Use this to tailor your content to meet your audience needs and wants, increasing your engagement and improving your brand experience. Facebook ads also contain sophisticated tools for market segmentation, including:

- Geographic: Choose a specific region or define it by population density.

- Demographic: Select age, gender, marital status, family status and occupation.

- Behavioral: Define groups by brand loyalty or user status (from non-users to regular users).

- Income: Select from lower, middle or upper class.

- Lifestyle: Segment by interests, according to keywords used in searches.

- Interests: Choose interests that intersect with the common pursuits of your chosen group

Selecting your target audience using these parameters when creating an ad campaign ensures you get the best return on ad spend (ROAS).

Incorporate ecommerce directly

Create online stores directly within the platform and make them visible on Instagram to reach more audiences.

You’ll need business accounts on both sites to do so but the set-up process is relatively straightforward.

Once you’ve created your accounts, refine your online catalog to target new and returning customers like State Bicycle Company, with over 400,000 followers, does when promoting its wide range of single-speed city bikes.

The community vibe associated with Facebook means the brand can create a Page that effectively blends news, articles, offers and competitions.

Easily measure your results

Facebook provides one of the best suites of social media analytics. We’ve produced a comprehensive guide to Facebook analytics, so here we’ll outline just the basics.

Facebook offers metrics on likes, comments, shares, Page views and other key performance indicators (KPIs). Track each customer’s journey to your Page to learn what strategies are proving most effective. Use Facebook’s analytics suite to further understand:

- Reach: See the number of people who saw and engaged with your posts including negative interactions, such as hiding or reporting posts for offensive content.

- Engagement: Engaged users are those who clicked anywhere in your post and those who created a story about your Page post.

- Likes: The number of likes tell you if your content resonated with your audience. Check what’s consistent about the posts that get the highest/lowest likes and you’ll likely find a pattern.

- Video stats: Check out how users interact with your video content including how long your content was viewed.

- E-commerce: Facebook provides insights and analytics through its Meta Page Insights tool and Meta Ads Manager for metrics on post engagements and reach. You can also view metrics on ad click-through rates and conversion rates. For more detailed e-commerce data like sales performance metrics, product views and customer demographics, you may need additional tools.

If you’re using Facebook to drive off-platform performance, Facebook Pixel lets you track user interactions and conversions beyond the platform and onto your website.

How to use Facebook marketing

To put your Facebook marketing into action, you’ll need a business Page and a Facebook ad account.

The first gives you a public-facing location, forming the focus of all your activities. Here’s ours:

A Facebook ad account via Meta Ads Manager allows you to create and position campaigns to raise awareness of your brand and convert prospects to customers across Facebook and Instagram.

Let’s take the process step-by-step.

Create a Facebook business Page

To reap the benefits of your Facebook marketing efforts, you’ll need a fully fleshed out Facebook business Page. Your Page represents your brand and first impressions can go a long way, especially in a digital terrain where everyone’s vying for your target audience’s attention. More importantly, your Facebook Page is also a medium to provide your customers with important information and address their queries. So let’s get into the details of how you can develop an efficient Facebook Page for maximum impact.

Step 1: Create a new, dedicated Page

On your main Facebook profile, click on “Pages” and “Create New Page” to generate your business Page. Give it a name and category, indicating the sector relevant to your brand. The name should match your brand or business name.

Step 2: Add biographical information

The optional “bio” section is where you’ll describe your business, what it offers and what makes it unique. When you’re finished, click “Create Page.”

Step 3: Provide business details

You want customers to be able to contact you, so here’s where you provide that information.

Step 4: Design your Page’s look

Here’s where you make your Page truly eye-catching. There are two main visuals to consider: the cover image that runs across the top of your Page and the circular profile image that sits on top.

Ensure your image choice aligns with your brand style book and visual strategy. Some brands lead with a founder or CEO photo for their profile picture, while others opt for their logo. Use whatever fits best with your brand’s visual identity.

Optional extras include action buttons like “book now” or “view shop,” and various other options for direct messaging (including Facebook messages, WhatsApp messages and email.)

Create a Facebook ad account

Once your Facebook Page is up and running, you’ll need to create an ad account. You do this from your Meta Business Suite (formerly Facebook Business Manager) dashboard. If you don't have a Business Manager account, don’t worry, we’ve created a comprehensive guide to Facebook Business Manager too.

Note that you can only complete the following steps if you are a page administrator, or have been assigned an admin, editor or advertiser Page role by an existing Page administrator.

From your Meta Business Suite dashboard, here are the steps to set up an ad account:

Step 1: Link your new Page

Under “Pages” click on “Add page” and your Page will be visible from the Business Manager.

Step 2: Create a new ad account

Under “Ad accounts” click on “Create Ad Account” (or “Add Ad Account” if you already have at least one account you’re using).

There is a limit set by Facebook on the number of ad accounts a business may hold, which increases with advertising spend. You can check your ad account limit in Business Manager.

Step 3: Name the new account

Give your new ad account a name and complete the time zone, currency and payment method details. Select the business Page you added earlier to link it to the new Ad account.

How to create a Facebook marketing strategy

There are numerous factors to consider while developing your Facebook marketing strategy. If you’re building your Facebook strategy from scratch, here are tips that serve as building blocks needed for Facebook marketing strategy.

Set goals for your Facebook marketing

Facebook is used for several different purposes so take a systematic approach and think carefully about your goals. Is it to raise brand awareness, build customer loyalty or increase conversions? Here are some goals to consider for your strategy:

- Add more value to the brand: Per The Sprout Social Index ™, 68% of consumers follow brands on social media to find out about new products or services. Make Facebook your go-to source for brand awareness, leveraging the global platform to introduce your brand to new audiences while also keeping it top-of-mind for existing customers.

- Connect with customers: Our Index also found that 51% of consumers think the most memorable brands on social respond to customers. This is your chance to use the platform not only to reach new audiences but also to nurture customer loyalty.

- Improve sales: Improving the quality of sales starts with better targeting. Reach your target audience more efficiently through a well-planned Facebook marketing strategy. Test various targeting options and content types to see which generates the most conversions and quality leads, improving your ad spend and social selling.

- Recruit efficiently: Facebook can also support your recruiting efforts, like reaching top talent faster. Use the platform to showcase your brand values and culture to promote your employer branding.

Know your Facebook target audience

One of the major advantages of marketing on Facebook is the ability to target a highly specific slice of those 3 billion monthly users. You can do this by using Facebook’s Audience Insights tool.

This provides information about Facebook users in general and the specific subset of users who have interacted with your Page, by following, commenting, liking, sharing, etc.

The Insights dashboard will reveal where your followers are located, their age and gender, and useful information about content preferences. It also informs you which devices people use to access your Page. Use insights you draw from the tool to build out the organic side of your strategy and create highly-targeted advertising.

Some of the ways you can use the dashboard are:

- New audiences: Select your target locations, demographics, behaviors and interests.

- Custom audiences: See existing audiences you’d like to contact with new products, services or offers.

- Lookalike audiences: Discover audiences similar to people who have liked or otherwise engaged with your Page.

- Saved audiences: Save and view targeting parameters you saved for future use. For instance, you might have a US-based demographic aged 25–40 saved, but also a global 18–25 audience.

By being highly specific about who you are targeting with your Facebook marketing efforts, you’ll ensure a better ROAS and conversion rate and see an increase in your organic growth.

Publish a mix of content to your Facebook feed

Create a dynamic feed with engaging content with a mix of content formats that engage your audience in various ways.

There are several different post formats you can use, including:

- Static posts: Text-based content that doesn’t have dynamic elements.

- Images: Static images that showcase your brand.

- Videos: Videos that can vary in length and are used to showcase interesting content such as interviews, product demonstrations, seasonal content, helpful hints and animations.

- Stories: Short and temporary content such as photos or videos that disappear after 24 hours and can be viewed on Facebook, Messenger and Instagram.

- Facebook Reels: Short-form video formats akin to those found on Instagram or TikTok with highly-entertaining clips designed to quickly capture viewer attention.

You can also take advantage of different Facebook interaction types such as:

- Allowing your followers to message you directly through WhatsApp or Facebook Messenger

- Tagging products in your photos for followers to immediately make a purchase

- Supporting local charity organizations by adding fundraisers

- Creating humorous content by attaching GIFs to engage your audience

Interactive content draws engagement too, such as competitions, challenges and trends that encourage followers to share or repost your content.

These options enable you to creatively connect with followers in the ways they want to consume content. Inform your direction with the goals you have outlined and audience insights you’ve gathered.

Boost posts or leverage Facebook ads to generate leads

Incorporating a paid marketing plan with your larger Facebook strategy will give you a comprehensive strategy that engages and converts your audience. Your paid strategy should include boosting organic posts and traditional Facebook ads.

Boosted posts enable you to focus on Page engagements, clicks and promotions. They appear in the feed like organic posts and are a great way to quickly reach new audiences with a successful organic post. Facebook ads created in the Ads Manager are aimed more at drawing new customers, are more targeted and appear in feeds as an ad.

You must determine your monthly ad budget so you’re able to efficiently manage ads to increase reach, generate more sales and build brand awareness while using spend wisely. Targeting a broad audience isn’t a bad thing, especially at first, so you can see what works best to build awareness. Then as you see a pattern, build out custom audiences based on user behavior and interests.

If it’s a retargeting measure, make sure the content provides something recognizable but also something new.

Your ad design should focus on:

- Identity: Does it relate to your brand and effectively showcase your product/service? Are your logo and business colors correctly displayed?

- Reward: What do viewers get out of it? Is it a deal, promotion, offer code, whitepaper or industry guide?

- Tone: Does your content maintain the same tone across your entire Facebook Page or business in general?

- Action: Your content must drive an action, which goes back to your Facebook goals. A clear and precise call to action is best.

Use product photos, branded graphics or videos to help capture your audience's attention. Make sure your ad copy entices the viewer to take action.

Post when your followers are most active

Facebook marketing only works when your chosen audience is paying attention. Ensure your content posting schedule is optimized to reach the largest audience by posting at times they’re most active on the network.

Sprout identifies the Optimal Send Times for your brand by using algorithmic analysis of the Facebook platform and your posting history to identify when your audience engages most. These times are continually updated and revised to help you post when it counts most.

Check out our article on Facebook posting schedules for details like posting based on your industry and more.

Use Facebook bots and other interactive tools

Chatbots and interactive tools are automated solutions to engage with your audience. Bots can be programmed to answer a large volume of common queries, freeing up your social teams for more complex tasks while ensuring your customer gets support 24/7. Interactive tools help enhance audience engagement and can be used to promote quizzes, polls, surveys, contests and other interactive content.

Take advantage of Facebook chatbots for customer service to answer predictable queries and respond to compliments and criticisms. These bots can also be used to recommend new products to individuals likely to engage or respond with targeted marketing content in response to search queries. For instance, when a Page visitor searches for “winter footwear,” your bot might throw up advertisements for your shoe brand, or for related items such as scarves or hats.

With chatbots becoming more intuitive and popular, it’s easier to give customers the information they need faster and keep them happy. As the Index data showed, 23% of customers expect a brand to respond to their query within two hours.

Use a content calendar to post and schedule fresh content

Content creation and curation are important components of any social media strategy. Creating a content calendar ensures you’re engaging with audiences regularly and have a steady flow of relevant and fresh content. This is especially useful during the holidays.

But if you're posting everything in real-time, you'll only have time for your Facebook content production and not much else. This is why scheduling your content out in batches is key.

For scheduling Facebook content, you have both free and paid options available to you. Facebook’s Page controls allow you to schedule your posts right from your Page. Sprout enables you to schedule Facebook posts and post across your social platforms, as well asl pick the best times for you based on your highest expected audience engagement.

Scheduling and planning your calendar makes it easier for you to see where gaps are in your social content strategy. Using a tool like Sprout not only helps visualize this, but also collaborate with other team members to create, review and approve content.

Engage proactively with your audience

Like most social media channels, Facebook is built as a network to converse, discuss and share content. That means conversation and engagement should never be put on the back burner. Incorporate a plan to build a community with your audience. Use Facebook to hold industry chats or discussions, whether it’s with subject matter experts or your customers. Engage existing customers with interesting content, build customer care relationships and attract prospects with what differentiates you from the crowd.

Work to create content that solicits engagement from your audience—but also don't be afraid to ask for engagement as well. Have your audience react to your posts to vote on something. Ask questions. Share polls. The possibilities are endless to start building up your Facebook engagement.

Track and analyze your results

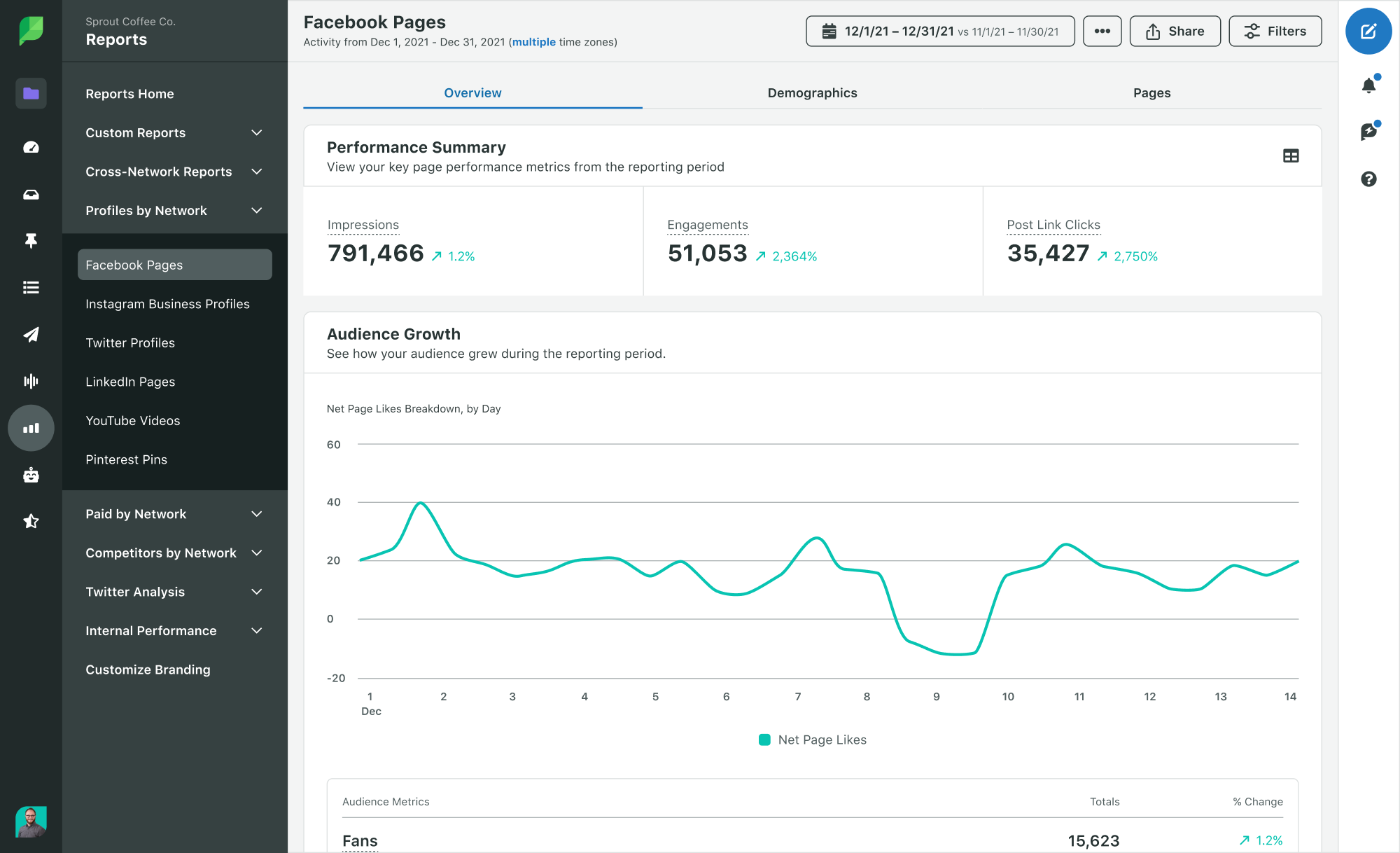

Keep an eye on the metrics you identified earlier in goal setting and analyze the results to understand your Facebook marketing strategy’s performance and determine your ROI. Sprout’s Facebook analytics enables you to see if you need to change the types of content, ads and engagement strategies you're employing or if what you're doing is working.

Monitor to see if your Facebook performance is increasing or decreasing month-over-month, so you can make any necessary changes to continual drive growth and performance in your Facebook marketing strategy.

4 successful Facebook marketing examples to inspire your brand

Below, we’ve selected four brands who, in different ways, have excelled with their Facebook marketing campaigns.

BMW

BMW has over 20 million followers on Facebook thanks to its image-driven content which highlights their innovations and style. The brand showcases its technology and automotive aesthetics using both brand imagery as well as user-generated content. It's posts also reflect special events and holidays.

Note their use of hashtags and emojis to add personality to what could easily otherwise seem a bit corporate. The “Learn More” button on the top of their Page leads to their main consumer site. There’s also a “mentions” tab at the top of their profile which takes the visitor to all their latest model reviews and customer comments.

Takeaways: Stunning imagery doesn’t have to be expensive. Leverage your user-generated content where you can to highlight your positive reviews and showcase your offerings. Plus, make sure you give your audiences access to more information so they can explore your brand even further.

Sephora

Makeup retailer Sephora uses its Facebook to regularly engage with its audiences and keep them invested in the brand. They focus on striking visuals and dynamic content formats, including high-quality images and videos to promote the various brands under their umbrella.

They also use the page to promote quizzes, polls and makeup tutorials and to showcase influencer content that entertains and educates their audience. The brand’s Facebook Page is also a major tool for prompt customer service. They encourage customers to DM them for more information so they can address concerns through private messages and comments.

Takeaways: Combine your creative content with prompt and personalized responses for more dedicated customer care. Last but not least, promote your other customer care channels for maximum engagement and impact.

Wendy’s

Wendy’s is known for their social content. On Facebook, they use a mix of video and static content, including user generated content, to build and sustain momentum around their different menu items and special offers. Plus, they respond to almost all post comments.

They also publish posts simply to engage in conversations with their followers—a strategy that has paid off. Audiences know the brand engages with them and this has built trust and customer loyalty.

Takeaways: Choose a brand persona for your Facebook presence that matches your brand values and amplify it in your content and responses. Keep your audiences engaged by responding to them promptly and ensure steady customer care to boost customer delight.

Pizza Hut

Pizza Hut’s strategy is straightforward. They use the platform to share mouthwatering posts and videos of their dishes. They also use the platform to showcase community engagement and announce promotions and specials such as discounts, limited-time deals and new or limited-time menu items. They also run contests and polls where audiences share their favorite menu item or pizza toppings.

Takeaways: Your product is your USP and your customers and followers are your strength. Don’t hesitate to leverage them for creating engaging content and enhancing your share of voice. Encourage your followers to submit creative content related to your brand and share their experiences. This increases community engagement and also gives your teams plenty of content to build on.

4 Facebook marketing tools to give your strategy a boost

Facebook has many native and third-party tools to help you manage your Facebook marketing strategies. We’ll finish by highlighting just four of them. For a longer rundown, read about 12 Facebook marketing tools that can help your business scale on the platform.

Sprout Social

Use our suite of social media tools to optimize your Facebook marketing across content scheduling and audience analytics.

Manage and schedule your social media assets and receive detailed analytics on campaign performance and audience interaction through intuitive dashboards. Analyze everything from individual post reach to audience growth and ROAS from a single source of truth while managing all your other social channels.

Use Sprout’s Listening tools to understand your audiences and discover trends and topics your target audience is interested in. Find out what kind of content is resonating the most, how your audience growth is shaping and how your competitors are doing in the same space.

Creator Studio for Facebook

Facebook’s Creator Studio helps users schedule posts, track social assets and monitor posting performance for actionable insights. It integrates with Instagram, and with Meta’s several ad features. It’s available for download on iOS and Android devices so you can manage your Facebook Page content and connect with your audience anytime, anywhere.

Using just this tool, you should be able to track trends and create an approval workflow. It’s important to note though, that it’s limited to managing only Facebook networks

Facebook Commerce Manager

For direct selling on Facebook and Instagram, this tool helps you establish a shopfront presence on both platforms. With Facebook Commerce Manager, you can create catalogs and customizable collections to help your buyers find exactly what they need, and push products they may want.

Customer service can be managed from the tool too, as well as returns and inventory management.

Facebook ads library

If you need a little inspiration, Facebook’s ads library is a great resource for finding out what worked, who partnered with whom and what your competition is up to.

It’s a searchable database of everything that’s running or has run across Meta’s platforms.

For each brand searched, you will see when their page was created, what ads are running and even ad spend (for political or social ads only). Using this tool before you craft your campaign may help you stand out from the competition.

Manage your Facebook Pages and Messenger conversations more effectively

Facebook marketing can be a complex process involving audience targeting, content creation, performance analysis and competitive intelligence. However, using Facebook’s various resources and integrating the advice above will enable you to optimize your Facebook presence.

As you build your community, use Sprout’s Facebook management tools to simplify your workflows, get deeper audience insights and manage your Pages all in one place.

Facebook Marketing FAQs

Are there Facebook marketing courses?

Yes! Users can find free courses on Facebook marketing on Meta Blueprint for those who want to strengthen their marketing skills across Facebook, Messenger, Instagram and WhatsApp.

How do I create a Facebook business page?

It’s easy to create a Facebook business page! Head to Facebook.com and click the menu icon (nine dots) in the top navigation bar. Click Page under the Create menu to get started. From here, Facebook will walk you through all of the information you need to fill out in order to completely optimize your business page.

Additional resources for Facebook Marketing

12 Facebook publishing tools for your brand in 2024

The picture-perfect Facebook cover photo size

Facebook Event photo size & dimensions guide

Facebook automation: The ultimate guide for your brand

Facebook marketing: The complete guide for your brand’s strategy

Creator Studio for Facebook and Instagram: A guide for marketers

How to build a Facebook business Page that attracts customers

12 Facebook marketing tools to help your business scale

Facebook Shops: What are they and how to drive more social sales

7 Fundamental Facebook best practices to grow your presence faster

How to build your community with Facebook Groups

A step-by-step guide on how to use Facebook Business Manager

Facebook Lookalike Audiences: How to optimize ads to reach new customers

5 brilliant Facebook campaigns (& why they worked)

15 Facebook post ideas to increase engagement

How to use Facebook tools to boost your success

12 Ways to use Facebook events for your brand

Expert tips on using Facebook for your small business

The new Facebook features every marketer should know about

Instagram vs Facebook: which is best for your brand’s strategy?

Your Handy Guide to Facebook Marketing Terms